Welcome to another Logistics News Update.

Spring has sprung, bringing with it a breath of fresh air and renewed optimism for South African logistics.

While the weather has played its part in improving operations, the industry continues to face significant challenges. Transnet, the state-owned logistics company, has announced a staggering R7.3 billion loss, adding to the mounting pressure on the struggling entity. The recent R5.7 billion loan from the BRICS Bank offers a lifeline, but the question remains: is this enough to turn the tide? As we navigate these turbulent waters, the need for innovative solutions and strategic partnerships becomes increasingly apparent. Could a public-private partnership be the key to unlocking the potential of South African logistics? We’ll delve into these issues and more in this week’s newsletter.

*Many readers have requested to focus on certain pressing issues, we have tried to gather information on the ground but none that we can confidently report back on but are working on it, we thank you for interacting with us.

Did you know?

Weather improvements have led to fewer delays in recent logistics operations. However, the use of split berths by vessels continues to pose challenges. Additionally, containers that bypassed Durban are now stuck in other ports, making it difficult for shipping lines to move them. While transporter delays have decreased, the overall impact on container collection remains significant.

NEWS

MSC send out a notification:

- MSC Abidjan, a container ship operating in Coega port, has been facing significant delays due to extreme vessel movement and windbound conditions. Coega ports have temporarily suspended berthing operations from August 26th to 29th.

- Three MSC vessels are being diverted to Durban to seek shelter from adverse weather conditions. These disruptions will affect berthing schedules and lead to delays in the arrival of Cape Town import cargo.

- To minimise delays and transhipments in Ngqura Container Terminal (NCT), MSC is exploring the option of keeping European cargo onboard the vessel for direct discharge in Cape Town on the northbound call. This decision is subject to change based on the situation.

- MSC Carole, scheduled to arrive in Coega around August 29th, has attempted to block stow Cape Town cargo from Europe for direct discharge in Cape Town. However, some cargo may still need to be discharged in Coega for transhipment.

- Cape Town port itself was also affected by windbound conditions on August 26th, with swells reaching 6.7 meters.

supplied by Richard Rattray Concordia

Disclaimer: The information presented in this newsletter is based on reputable sources and has been referenced accordingly. This Logistic News is provided obligation-free. If you wish to be removed from the mailing list, please reply to this email with a request for removal. Please note that all news content is either adapted or specifically quoted from its original sources.

This Weeks Key News Takeaways

- Transnet signs R5bn loan agreement with NDB to modernize logistics infrastructure.

- Potential solutions identified to solve harbour carrier hold-ups.

- Fuel price cut on the cards as inflation hits a three-year low.

- Houthis detonate explosives on blazing tanker in Red Sea, potentially causing a major oil spill.

- Port of Beira hits record cargo volumes due to growth in regional imports and exports.

- DoT calls for urgent action on aviation disruption caused by long auditing processes.

- New export markets can ease decline of canned fruit exports from South Africa.

- Container ship orders surpass 2023 contracts as demand reaches its third-highest level in 20 years.

Source: Freight newsSource: Freight news

NEWS

Decrease of up to 70% in ocean rates anticipated

23 August 2024 – by Eugene Goddard

Ocean freight rates are projected to drop by as much as 70% in the second half of 2025, marking one of the most significant declines in the history of container shipping, according to Linerlytica. This sharp decrease is attributed to the ongoing slide in rates since July 2024, exacerbated by overcapacity due to the delivery of new vessels and waning demand. Despite attempts by carriers to stabilize rates, the Shanghai Container Freight Index (SCFI) and the more accurate SCFIS have shown consistent declines, with no rebound expected in the near future.

The drop-in rates could be influenced by the restoration of maritime trade through the Suez Canal to pre-crisis levels, as suggested by Xeneta. The disruption caused by Yemen’s Houthi rebels has significantly impacted traffic through the canal, and without resolution, the anticipated rate drop might not fully materialize. Additionally, freight futures have weakened, with long-term contract rates trading at substantial discounts, further signalling a prolonged decline in the market.

As the global container shipping market faces these challenges, Xeneta highlights that the situation in the Red Sea has shifted market dynamics from overcapacity to a tighter market, despite an increase in shipping volumes. However, the current market is not driven by demand, and with the significant increase in fleet size since 2019, the industry is navigating a complex environment with no immediate signs of recovery in freight rates.

Adapted from Source: Freight News

Potential solutions identified to solve harbour carrier hold-ups

30 August 2024 – by Eugene Goddard

Source: Redmond Magazine

As Transnet’s two-week testing phase at Durban Container Terminal (DCT) nears its conclusion, adjustments have been made to enhance harbour carrier efficiencies, particularly for cold chain reefer boxes and out-of-gauge loads. Earle Peters, Durban Terminals’ chief executive at Transnet Port Terminals (TPT), highlighted that specific cargo types had caused avoidable delays, with the differing systems for import and export containers contributing to ongoing challenges.

To address these issues, Peters emphasized the need for private-sector cooperation in adopting Transnet’s 24/7 operational model, which could alleviate congestion by spreading container movement more evenly throughout the day. Business Unity South Africa (Busa) has been engaged to encourage transporters to adjust their working hours, and there has been a positive response from various sectors willing to review their schedules.

While the trial phase may be extended, Peters is optimistic about the progress made in resolving long-standing delays at DCT. He also noted improvements in communication with transporters, particularly regarding truck-slot booking systems, creating greater transparency and collaboration between TPT and the transport community.

Adapted from Source: Freight News

PORTS

Summary: South African Port Operations

Key Challenges:

- Adverse Weather: Strong winds, high swells, and rain impacted operations in Cape Town, Durban, and the Eastern Cape.

- Equipment Breakdowns: Crane failures and equipment shortages caused delays in multiple ports.

- Truck Congestion: Richards Bay experienced an influx of trucks, leading to congestion and delays.

Port-Specific Updates:

- Cape Town: Operations severely disrupted due to weather and vessel ranging.

- Durban: Multiple vessels at anchor due to equipment issues and weather. Fayston Farms finally berthed after a 26-day wait.

- Richards Bay: Experienced truck congestion and handled 165,763 tons of coal.

- Eastern Cape Ports: Over 50 operational hours lost due to weather and crane breakdowns.

Overall:

South African ports continue to face challenges due to a combination of weather-related issues, equipment breakdowns, and operational inefficiencies. These disruptions have a significant impact on the country’s trade and economy.

Port Delays

- Durban:

- Pier 1: 7–9-day delay

- Pier 2: 10–16-day delay

- Durban Point: 3-day delay

- Cape Town:

- CTCT: 2–5-day delay

- MPT: 1–2-day delay

- Port Elizabeth:

- PECT: 2–5-day delay

- NCT: 1–5-day delay

NOTE: We recommend factoring these potential delays into your shipment planning to avoid disruptions.

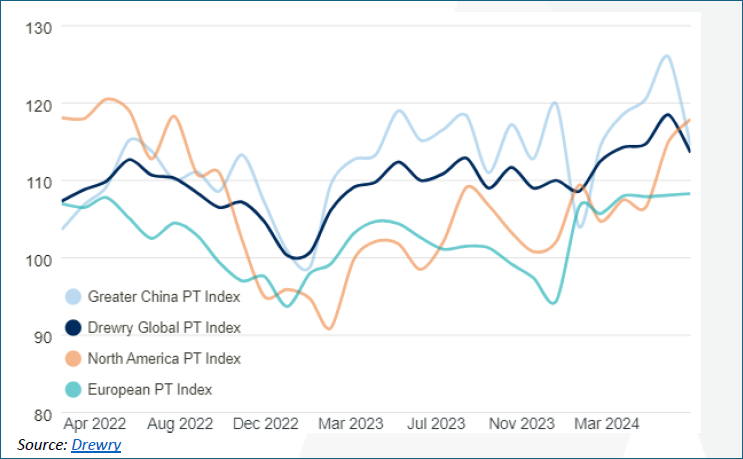

Summary: Global Shipping Industry – Port Throughput Indices

Key Trends:

- Global Index: Increased in June but expected to decline in July.

- Regional Performance: China and North America showed strong growth, while the Middle East and South Asia saw modest increases.

- Africa: Experienced significant year-on-year growth.

Overall:

The global container shipping industry continues to demonstrate resilience, with strong growth in certain regions. However, factors such as summer holidays in the northern hemisphere could impact overall throughput in the coming months.

BUSA-SAAFF Summary – SBUSA-SAAFF Summary – Summary

South African Logistics and International Trade Update

This week saw continued challenges across South African ports, with adverse weather and equipment breakdowns severely impacting operations. Cape Town and Durban ports experienced significant delays, with over 50 operational hours lost at Eastern Cape ports. The Port of Richards Bay also faced congestion due to an influx of trucks. On the global front, the “Global Container Port Throughput Index” for June 2024 showed a 3.3% increase month-on-month, though a 4.1% decline is expected in July. Schedule reliability remained stable but is still lower compared to last year. Despite this, the industry remains hopeful with some indicators trending positively. In air cargo, ORTIA saw a slight increase in cargo handled, with year-to-date figures up 15% compared to August 2023. Globally, air cargo tonnages rebounded by 5%, driven by an 11% increase in the Asia Pacific region following a dip due to Typhoon Ampil in Japan.

Looking ahead, the slow pace of structural reforms in South Africa’s logistics sector continues to be a concern. Greater private sector involvement, particularly in ports and rail, is seen as crucial for improving Transnet’s operations. The recent R5-billion loan agreement with the New Development Bank offers some short-term relief, but long-term success will depend on closer collaboration with private sector operators.

Source::BUSA

This week’s news was brought to you by:

FNB First Trade 360 – a digital logistics platform and Exporters Western Cape

“This information contained herein is being made available for indicative purposes only and does not purport to be comprehensive as the information may have been obtained from publicly available sources that have not been verified by FirstRand Bank Limited (“FRB”) or any other person. No representation or warranty, express, implied or by omission, is or will be given by FRB, its affiliates or their respective directors, officers, employees, agents, advisers, representatives or any other person as to the adequacy, reasonableness, accuracy or completeness of this information. No responsibility or liability is accepted for the accuracy or sufficiency thereof, or for any errors, omissions or misstatements, negligent or otherwise, relating thereto. In particular, but without limitation, no representation or warranty, express or implied, is given as to the achievement or reasonableness of, and no reliance should be placed on, any projections, targets, estimates or forecasts and nothing contained herein should be, relied on as a promise or representation as to the past or future. FRB does not undertake any obligation to provide any additional information or to update the information contained herein or to correct any inaccuracies that may become apparent. The receipt of this information by any person is not to be taken as constituting the giving of any advice by FRB to any such person, nor to constitute such person a client of FRB.”