Welcome to another Logistics News Update.

PLEASE NOTE! IMPORTANT SARS UPDATE FOR IMPORTERS:

Invoice Data Now Mandatory on Customs Declarations SARS now requires all Customs Declarations to include full Commercial Invoice details that were previously only captured on the Worksheet. This includes supplier and importer names with full contact details, invoice number and date, incoterms, payment terms, currency, and a detailed English description of goods. Key data such as SOB date, rate of exchange, and dutiable charges must also be declared. This move is part of SARS’s strategy to enhance compliance in both classification and valuation by leveraging expanded data and advanced analytics. Remember, it is the importers responsibility to supply these details to their clearing agent.

This Week: Judgement Day for US Tariffs?

This is the week many are calling “judgement day” for US tariffs. President Donald Trump is set to announce new tariffs that could significantly impact South Africa’s automotive export industry. We should know the outcome today and whether local manufacturers will be affected. As reported by FreightNews, “One of South Africa’s biggest beneficiaries of duty-free access to the American market under the African Growth and Opportunity Act (Agoa) will have to wait until next Thursday to hear if any locally made automotive parts and fully assembled vehicles will also be subjected to the imposition of stiff US tariffs.” Trump is expected to impose a 25% tariff on all imported motor vehicles and certain auto parts, with the measures taking effect from 3 April 2025.

According to the Trump administration, the goal is to boost domestic manufacturing and raise an estimated $100 billion in tax revenue. However, US industry experts warn this could drive up vehicle prices for American consumers—by thousands of dollars in some cases. The Automotive Business Council (Naamsa) has voiced serious concern over these developments. Until the official announcement is made, we remain in a holding pattern—hoping South Africa’s duty-free benefits remain intact.

Trump’s Proposed Port Tariffs Could Backfire:

The International Chamber of Shipping (ICS) has warned that US President Donald Trump’s proposed tariffs on Chinese-built vessels could do more harm than good. The plan includes port stacking fees of up to $3 million per vessel call, aimed at boosting US shipbuilding and reducing China’s maritime influence. While the initiative is backed by US steelworkers and producers, ICS Secretary-General Guy Platten cautioned that these tariffs could disrupt global supply chains, raise costs for US consumers and exporters, and weaken the competitiveness of key sectors like agriculture, energy, and manufacturing. ICS stressed that the move could ultimately threaten US food, energy, and economic security. They’ve urged the US to consider alternative strategies that support shipbuilding without damaging trade. The chamber has offered to collaborate with policymakers to find more balanced, sustainable solutions. Source: Atlantic Council

On The Ground

- Reefer Demurrage Update: Please note: From 1 May to 31 October 2025, Transnet has announced a reduction in REEFER demurrage free time for Durban, Port Elizabeth, and Ngqura Terminals. Free days will be reduced from 3 days to 2 days during this Reefer Peak Season. Be sure to plan accordingly to avoid additional charges.

- Apple exporters have suffered out of Cape Town due to the wind and the outlook for citrus looks bullish according to the Citrus Growers Association chairman, said Gerrit van der Merwe.

- A Chinese agent has advised that freight rates may begin to rise from 15 April, with further increases expected from 1 May. Maersk has accepted significantly more bookings than their current allocation, with approximately 800 FEUs already rolled over. Additionally, they’ve experienced operational challenges on sailing 511S, where many bookings missed the second-leg vessel at TPP port due to limited handling time—affecting around 1,000 FEUs. As a result, Maersk may not accept new online bookings for April, which could shift demand to other carriers. MSC’s first vessel in May is a smaller 2,500 TEU ship, and they’ve also scheduled a blank sailing afterward, further tightening space. While Maersk is considering replacing their smaller May vessels with larger ones, this is not yet confirmed. Given these developments, we recommend securing your bookings as early as possible to take advantage of better rates.

Let’s Learn: Mandatory Commercial Invoice Details for (SARS) Customs Declarations:

- Full name of importer/consignee – including address and contact details

- Invoice number

- Invoice date

- Incoterms

- Payment terms – e.g. 30, 60, or 90 days

- Full description of goods – in English, with or without tariff codes

- Correct currencies used

- SOB (Shipped on Board) date

- Rate of exchange

- Date of rate of exchange

- Details of dutiable charges

- Discounts, if applicable

NEWS

Automotive industry on tenterhooks as Trump tariffs gear up

28th March 2025 – Staff Reporter

South Africa, one of the biggest beneficiaries of the African Growth and Opportunity Act (Agoa), may soon face a major challenge as the US considers extending new tariffs to locally made vehicles and auto parts. This follows a recent announcement by former US President Donald Trump that a 25% tariff will be imposed on imported cars and certain components, starting on 3 April. These tariffs cover a wide range of vehicle types—including sedans, SUVs, and light trucks—as well as critical parts like engines and electrical systems.

Although the tariffs are largely aimed at European and Asian exporters, it’s still unclear whether South Africa’s duty-free access under Agoa will be affected. The Automotive Business Council (Naamsa) and the National Association of Automotive Component and Allied Manufacturers have expressed concern but indicated that the industry is in a holding pattern until the US decision becomes clear. Naamsa says it is staying in close communication with its members, while NACAM CEO Renai Moothilal voiced serious concern about the potential impact on local manufacturing.

South Africa exported roughly $1.6 billion in fully assembled vehicles and $62 million in parts to the US in recent years, the majority under Agoa. Since 2000, motor vehicle exports to the US under this trade agreement have totalled around $22.5 billion. Should these exports lose their duty-free status, it could have a major knock-on effect on the country’s automotive sector, which relies heavily on access to the American market…

– Source: FreightNews, Eugene Goddard, including various sources.….

WEEKLY SNAPSHOT

- Cape Town Wind Delays Impact Apple Exports: Adverse weather conditions, particularly strong winds, have caused delays at the Cape Town Container Terminal, affecting apple export volumes. These disruptions have raised concerns among exporters about meeting international market demands

- Zimbabwe’s Non-Tariff Barriers Hamper Road Freight Trade: Non-tariff barriers in Zimbabwe continue to challenge road freight operators. A recent incident involved a transporter incurring a $1,920 loss due to an unfounded inspection, highlighting the financial risks posed by such barriers.

- Citrus Industry Faces Logistical Challenges: The citrus industry is grappling with logistical inefficiencies, with a recent study estimating annual losses of R5.27 billion. These challenges underscore the need for improved logistics to support the industry’s growth and export potential.

- Rise in Online Shopping Impacts Traditional Retail: The momentum of online shopping continues to affect brick-and-mortar stores. Innovations enhancing the online shopping experience are driving this shift, prompting traditional retailers to adapt to changing consumer behaviours.

- Demand for Complete Visibility in Freight Operations: Customers are increasingly demanding complete visibility in freight operations. The industry recognizes that meeting these expectations is key to achieving sustainability and customer satisfaction.

- Automotive Industry Awaits Potential US Tariffs: The South African automotive industry is on edge as potential US tariffs loom. The National Association of Automobile Manufacturers of South Africa (Naamsa) is in ongoing discussions with its members, adopting a wait-and-see approach to the evolving situation.

- US Port Fees May Be Counterproductive: Industry insiders express concern that new port fees in the US could harm the competitiveness of the American maritime sector. There is scepticism about the effectiveness of these fees in addressing trade imbalances, particularly with China.

- US Coast Guard Approves Nigerian Port Security: The US Coast Guard has given a security nod to Nigerian ports following evaluations aimed at lifting conditions of entry for vessels traveling from Nigeria to the US. This approval is expected to facilitate smoother maritime operations between the two countries.

- SAA Cargo Enhances Regional Freight Connectivity: South African Airways Cargo has strengthened its regional freight connectivity by partnering with Millennium Intertrade Africa Limited for the Dar es Salaam route. This collaboration is anticipated to expand SAA’s footprint in the Tanzanian market.

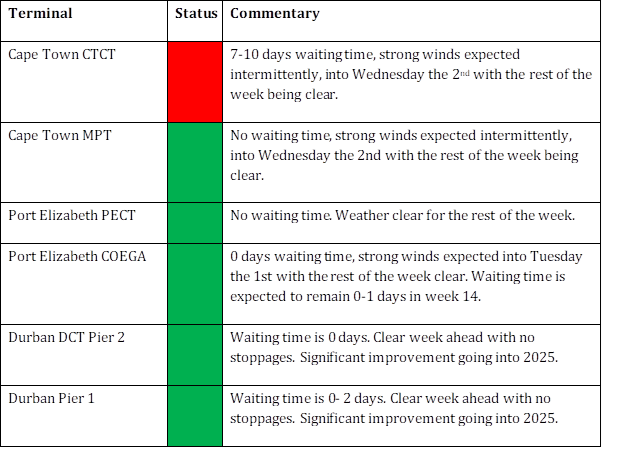

Port Operations Summary: – Port Update:

SOUTH AFRICAN PORTS

BUSA SUMMARY

This week’s logistics highlights show a 7% year-on-year increase in throughput at the world’s 30 largest container ports, with Shanghai leading the pack and Durban ranking around 90th globally, handling 2.6 million TEUs—similar to its 2009 volume when it was in the top 50. In air cargo, February saw international volumes rise in Johannesburg (↑12%) and Durban (↑19%), while Cape Town experienced a 19% decline. Meanwhile, stakeholders at an ACSA meeting raised serious concerns over lease delays, with 87% of cargo leases—93% at ORTIA—having expired, creating uncertainty around investment and operations.

Port Operations

Volume Drop: Container volumes fell by 8% week-on-week, with an average of 10,585 TEUs handled per day.

- Cape Town: Operations were disrupted by adverse weather and equipment issues. The Maersk Colombo skipped Cape Town and redirected to Coega due to a 10-day delay.

- Durban: Affected by equipment breakdowns, dredging, and weather.

- Pier 1: Stack occupancy at 66%, truck turnaround time increased by 38%

- Pier 2: Stack occupancy at 54%, staging time increased by 232%

- Eastern Cape Ports: Operations at Ngqura and Port Elizabeth were impacted by equipment shortages and vacant berths.

- Richards Bay: Reported minimal delays with stable daily volumes.

- Citrus Exports: Early season exports have commenced via Durban. The 2025 forecast stands at 106,000 FEUs, reflecting a 10% year-on-year increase.

Air Cargo

At OR Tambo International Airport:

- Inbound volumes averaged 541,659 kg/day (down 7% week-on-week)

- Outbound volumes averaged 376,084 kg/day (down 4% week-on-week)

Global Trade and Shipping

The world’s 30 largest ports recorded a 7% year-on-year throughput increase. Shanghai remains the busiest port, with Durban now ranked around 90th.

- Schedule reliability improved to 53.3% in February. Gemini Cooperation recorded 94% reliability at origin ports.

- HMM took delivery of the HMM Green, the first 9,000 TEU methanol-fuelled containership.

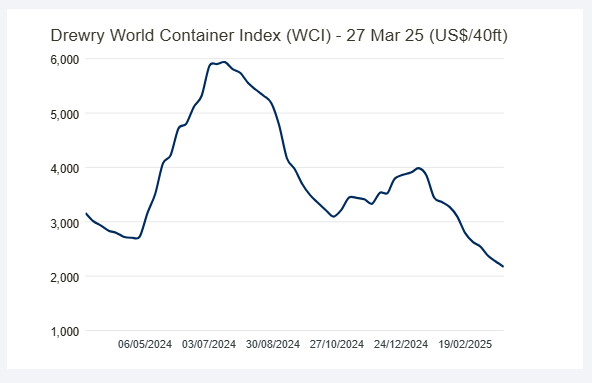

Freight Rates:

- World Container Index at $2,168 per 40-ft container (down 4.2% week-on-week)

- Harpex Charter Index up 71% year-on-year

- Global air cargo volumes dipped 1% week-on-week but remain up 3% year-on-year. Spot rates are at $2.69/kg, with a continued recovery following Lunar New Year.

- Rising demand for semiconductors may help offset declining e-commerce air freight. – Source: BUSA

Global Freight Rates

World Container Index – 28 March

Drewry’s World Container Index continued its decline, dropping 4.2% (or $96) to $2,168 per 40-ft container this week. This marks the lowest rate since early 2024 and continues the post–Lunar New Year correction trend. The current index remains 78% below its pandemic peak of $10,377 in September 2021 but is still 53% above the 2019 pre-pandemic average of $1,420. The year-to-date average for 2025 now stands at $3,127 per 40-ft container, which is $242 higher than the 10-year average of $2,885 (skewed by the exceptional rate surges from 2020–2022).

– Source: Drewrey

Disclaimer: The information provided in this newsletter is based on reliable sources and has been carefully verified. This Logistics News is distributed free of charge. If you wish to unsubscribe from our mailing list, please reply to this email with “unsubscribe” in the subject line. Please note that all content is adapted or directly quoted from its original sources. We take no responsibility for any inaccurate reporting; we are only adapting the news for you.

This week’s news was brought to you by:

FNB First Trade 360 – a digital logistics platform and Exporters Western Cape

“This information contained herein is being made available for indicative purposes only and does not purport to be comprehensive as the information may have been obtained from publicly available sources that have not been verified by FirstRand Bank Limited (“FRB”) or any other person. No representation or warranty, express, implied or by omission, is or will be given by FRB, its affiliates or their respective directors, officers, employees, agents, advisers, representatives or any other person as to the adequacy, reasonableness, accuracy or completeness of this information. No responsibility or liability is accepted for the accuracy or sufficiency thereof, or for any errors, omissions or misstatements, negligent or otherwise, relating thereto. In particular, but without limitation, no representation or warranty, express or implied, is given as to the achievement or reasonableness of, and no reliance should be placed on, any projections, targets, estimates or forecasts and nothing contained herein should be, relied on as a promise or representation as to the past or future. FRB does not undertake any obligation to provide any additional information or to update the information contained herein or to correct any inaccuracies that may become apparent. The receipt of this information by any person is not to be taken as constituting the giving of any advice by FRB to any such person, nor to constitute such person a client of FRB.”