Welcome to the final Logistics News Update of 2023.

It has been an eventful year in the logistics sector. Many people realise how important logistics is for the country and what a huge impact it creates if it doesn’t work properly.

THANK YOU to all of you who read our weekly logistics news updates. We appreciate it and assure you of the best logistics news in 2024.

Let’s reflect on what we have gone through this year and some of Clifford Blackburn’s personal views. Clifford is a member of our team who prepares this content on our behalf.

Overview

- Rising fuel costs: The price of fuel has increased significantly in 2023, which has had a major impact on the cost of transportation. This has led to some logistics companies passing on these costs to their customers, which has put pressure on businesses and consumers.

- Load shedding: Load shedding has continued to be a major problem in South Africa in 2023. This has caused disruptions to supply chains and has led to some businesses having to shut down their operations.

- Infrastructure constraints: South Africa’s infrastructure is not always up to the task of supporting the country’s growing economy. This has led to congestion at ports and on roads, which has slowed down the movement of goods.

- Local Transporters; Having to pivot, learning how to navigate a very turbulent and uncertain few months.

Despite these negatives, here are some positives;

- Growth in e-commerce: E-commerce has continued to grow in South Africa in 2023. This has led to a demand for more sophisticated logistics solutions, which has helped to drive innovation in the sector.

- Investment in technology: There has been an increase in investment in technology in the logistics sector in South Africa in 2023. This has helped to improve efficiency and productivity.

- Air Freight: Air freight has seen a huge increase in volumes in the very last productive month.

Key trends

Some of the key trends in the logistics sector in South Africa in 2023 include:

- The use of data and analytics: Logistics companies are increasingly using data and analytics to improve their operations. This is helping to improve efficiency, reduce costs, and improve customer service.

- The adoption of new technologies: There is a growing adoption of new technologies in the logistics sector, such as artificial intelligence, blockchain, and robotics. These technologies are helping to automate tasks, improve visibility, and make supply chains more resilient.

- The focus on sustainability: There is a growing focus on sustainability in the logistics sector. This is leading to the development of new technologies and practices that can help to reduce the environmental impact of logistics operations.

Outlook

The outlook for the logistics sector in South Africa is mixed. On the one hand, the challenges of rising fuel costs, load shedding, and infrastructure constraints are likely to continue to pose challenges. On the other hand, the growth of e-commerce and the investment in technology are likely to provide some growth opportunities. You can only navigate the problem areas if you can see them before they arise.

Overall, the logistics sector in South Africa is likely to remain a dynamic and evolving sector in the years to come, all of us who participate are learning to navigate the mess we call infrastructure “hiccups”.

NEWS

South Africa’s logistics crisis: congestion slightly down in Durban

Introducing more rubber-tyred gantry cranes into the system has bolstered performance at the Port of Cape Town. Source: Corvus Energy

There appears to have been a slight improvement at the Port of Durban where equipment failure has caused critical congestion, causing vessels to wait at outer anchorage with as many 71,000 containers delayed by as long as three weeks.

Thankfully, whereas the number of ships idling at sea was more than sixty at the peak of the port’s logistics crisis, vessels at anchorage have decreased to 51, reported the South African Association of Freight Forwarders (Saaff).

In its Daily Supply Chain Movement Report released at 2 pm on Wednesday, the association gave the breakdown of waiting vessels as follows: 24 container ships, 11 dry bulkers, four break-bulkers, and 14 liquid tankers while two reported as “other” vessels. A total of 31 vessels were at berth.

The available resources were five tugs, five berthing gangs, a pilot boat and one helicopter.

Up the coast at the Port of Richards Bay, where congestion caused by ore exports has caused significant supply-chain snags resulting in the town’s road gridlock and tipper trucks tail-backing far up the N2, Saaff said 18 vessels were at anchorage.

Source: FTW

Crippling logistics and energy woes are poisoning South Africa’s motor industry, Ford warns

Ford has spent more than R21bn to expand and upgrade its Silverton plant to assemble the latest Ranger model.

Persistent logistics and energy crises are a “slow poison” with major repercussions for the South African automotive manufacturing industry, says Ford Africa president Neale Hill.

Hill’s comments echo those of Volkswagen passenger cars CEO Thomas Schaefer who said South Africa was becoming an undesirable location for manufacturing cars because of issues such as load-shedding, rising labour costs and problems with Transnet.

Schaefer said last week production at its Eastern Cape plant in Kariega is safe for the next few years, but warned future production contracts were under threat.

Hill said the repercussions of the crises are far reaching.

“My concern is the automotive investment decisions being made now are not going to go our way and we’ll feel the effects in five years,” he told media at the launch of the Ford Puma compact crossover in Cape Town this week.

Bottlenecks at ports were forcing the company to use premium air freight for components to keep the production line going at its Silverton factory near Pretoria, where the Ford Ranger and Volkswagen Amarok bakkies are assembled for the domestic and export markets.- Source: The Sunday Times

Logistics expert says a direct capital injection would have demonstrated greater commitment by the Treasury

Prof Jan Havenga

File photo. Image: Thapelo Morebudi

Transnet welcomed the financial support from the government “as the company implements its recovery plan for the turnaround of the business”.

The R47bn credit guarantee facility advanced to Transnet by the National Treasury should rather have been a direct equity injection, says Stellenbosch University logistics expert Prof Jan Havenga.

A direct capital injection would have demonstrated the government’s commitment to funding rail and port infrastructure, he told the Sunday Times. “In all honesty, the government does fund roads, so it would be fair to fund rail infrastructure, but rail reform must first be in place, then infrastructure can be funded that will be available to all private operators,” he said.

Havenga said the R47bn was merely a sovereign guarantee that allows Transnet to borrow and the Treasury will guarantee repayment in case of a default. But at least it allowed the rail and ports company, which is saddled with a R135bn debt pile, to borrow at cheaper rates. “Sovereign guarantees open the door to cheaper debt, balance sheet restructuring, and better oversight,” he said, adding that the money will still need to be paid back. Source: The Sunday Times

VW executive worried about the future of firm’s SA operations

Business chamber says a newly introduced booking system for trucks involves manual registration processes that are wasting more time in getting cargo to and from the ports

WAITING FOR GREEN LIGHT Production of electric vehicles is steaming ahead in other parts of the world — as seen on the production line for Volkswagen’s ID.3 and Cupra Born electric cars at the company’s Saxony plant — but in South Africa policy delays are holding back the automotive industry. Image: Krisztian Bocsi/Bloomberg

A senior Volkswagen executive involved in a global cost-cutting strategy said on Friday that he was “very worried” about the future of the company’s operations in South Africa, which is facing persistent power cuts and logistics snarl-ups.

The company’s VW passenger car brand is in the midst of defining the key measures of a global scheme to boost its flagging margins — the first in a series of savings drives aimed at improving group profitability and staying competitive in the transition to electric vehicles (EVs). The German carmaker has been in South Africa for nearly 80 years.

Factors such as competitive labour costs once placed it among the company’s higher-ranking bases globally, VW brand chief Thomas Schäfer said during a visit to the country. But the cost of mitigating power outages caused by chronic production shortfalls at state-owned utility Eskom, as well as rising labour costs and logjams on railways and at ports, have eroded that advantage, he said.

Source: The Sunday Times

SA receives energy equipment donation from China

Source: CGTN

The first consignment of energy equipment donated by the People’s Republic of China was received by Minister in the Presidency for Electricity, Dr Kgosientso Ramokgopa, on Thursday.

The donation forms part of the Technical Assistance Programme that was entered into in August during China’s head of state visit to South Africa.

“The first consignment, which has arrived in South Africa, consists of 450 gasoline generators which will be distributed to public service facilities across the country,” the Presidency said in a statement.

“The generators will be used as backup to alleviate the impacts of load-shedding in the delivery of services in clinics, schools and courts while government continues to implement the Energy Action Plan to ultimately end load-shedding and create sustainable energy security,” the Presidency said.

Earlier this year, during an official state visit to South Africa led by Chinese President Xi Jinping, President Cyril Ramaphosa thanked the Asian nation for its support. . –SAnews.gov.za

Border Management Authority extends port operating

The Border Management Authority (BMA) is implementing a comprehensive plan, including longer border post operating times and more boots on the ground, for its festive season operations.

This according to BMA commissioner, Dr Michael Masiapato, who told the media at a briefing in Pretoria on Sunday that the agency was expecting at least six million people to move through the country’s borders during the holidays.

He said the agency had engaged with six neighbouring countries on the synchronisation of processes.

“While some of our busiest ports already operate on a 24-hour basis, Minister of Home Affairs Dr Aaron Motsoaledi has already approved our request to extend the operating hours on other identified critical ports on certain dates that we agreed with our immediate neighbouring countries,” Masiapato said.Source: FTW

SOUTH AFRICAN PORTS

DURBAN

Port berthing delays continues to be experienced due to high levels of congestion. The port has reported windy weather during the week.

- Pier 1 : 7 days

- Pier 2 : 20-29 days

- Durban Point : 3 days

CAPE TOWN

Port berthing delays has improved. The port has reported windy weather during the week.

- CTCT : 3-7 days

- MPT : 0-2 days

PORT ELIZABETH

Port berthing delays has improved. The port has reported windy weather during the week.

- PECT : up to 2 days

- NCT : 0 days

Source: SACO CFR

BUSA SUMMARY

Commercial ports handled an average of 8 410 containers per day, slightly down from the 8 486 reported last week. Persistent initiatives were undertaken to address the prevailing port backlog, albeit encountering significant operational impediments, notably adverse weather conditions, together with ongoing equipment breakdowns and shortages. Waterside congestion remains a concern at the port of Durban, with a total of 25 container vessels waiting at anchorage on Friday. At the same time, the Port of Cape Town’s inefficiencies have resulted in several negative changes concerning the vessel lineup for the coming week. Furthermore, minimal reports were received from TFR this week; however, the latest reports indicate that DCT Pier 2 had 97 over-border units on hand with a dwell time of 26 days and 149 ConCor units on hand on Friday, indicating that there was no positive news from this sector.

Internationally, global merchandise trade volume remained stagnant, showing a slight increase of ↑0,2% compared to the previous quarter but a ↓0,5% decrease y/y. Alphaliner’s analysis shows how global carriers adjusted their fleet during the COVID-19 pandemic, focusing on East-West trades for high freight rates. However, as main routes face rate pressure, carriers are shifting attention to North-South routes. The figures reveal a ↓4,5% y/y capacity reduction on the Transpacific, while Latin America and Africa experienced impressive capacity increases of ↑17,5% and ↑21,1%, respectively. Lately, the Asia-North America trade saw a 243 000 TEU slot reduction since November 2022. Carriers are implementing rate hikes ahead of the 2024 contract season, with initial success on FE-Europe routes. However, global port congestion remains around 1,77 million TEU, and Panama Canal restrictions impact containerships. Other developments this week included (1) South Korean seafarers are trying to stop HMM sale: ‘don’t forget Hanjin’, and (2) fleet-heavy ocean carriers are also stuck with too many containers.

In the air freight market, international air cargo to and from South Africa had a much-reduced week, with inbound cargo slightly down (↓3%) and outbound cargo significantly down (↓19%) on last week’s volumes. Internationally, worldwide air cargo demand patterns have continued to broadly follow last year’s seasonal trend into the final full week of November, including a significant dip in outbound tonnages from North America linked to last week’s Thanksgiving celebrations in the USA.

In regional cross-border road freight trade, average queue times decreased by almost an hour, while transit times were essentially unchanged from last week. The median border crossing times at South African borders increased by more than three hours, averaging ~17,4 hours (↑23%, w/w) for the week. In contrast, the greater SADC region (excluding South African controlled) was essentially unchanged and averaged ~6,7 hours (↑2%, w/w). On average, four SADC border posts took more than a day to cross, notably the usual suspects of Beitbridge, Kasumbalesa, Katima Mulilo (the worst affected at around two days to cross), and Martins Drift.

This week, the Presidency and B4SA released a joint statement6 on some of the updates from the joint collaboration, also covering the National Logistics Crisis Committee (NLCC). In summarising the feedback from the statement, the essential priority of logistics is to address the rapid deterioration of the country’s transport and logistics network. Moreover, the finalisation of the Freight Logistics Roadmap (FLR) through extensive consultations signals a clear pathway for reforming the logistics system to enhance efficiency and competitiveness. Aligning the Transnet Recovery Plan with the FLR is anticipated to unlock funding from both the public and private sectors. Key steps toward stabilisation include permanent leadership appointments within Transnet, operational improvements by Corridor Recovery Teams, progress in rail infrastructure management, and the confirmation and mobilisation of additional private sector security resources. These initiatives are all critical to restoring trust in our logistics network, as it is imperative for socio-economic growth and development. Noting that every dollar flowing through a port contributes, on average, $4,30 in value to the global economy7, we must get our ports and logistics network in order (acknowledged by another R47 billion lifeline from Treasury8), as it is a critical matter of national importance.

PORTS

Summary of port operations

The following sections provide a more detailed picture of the operational performance of our commercial ports over the last seven days.

Weather and other delays

Adverse weather and equipment breakdowns were the main culprits of operational delays in Cape Town.

Durban’s attempts at recovery were hampered by vessel ranging, equipment shortages and breakdowns, accompanied by inclement weather.

Our Eastern Cape Ports were also impacted by poor weather conditions, especially on Thursday.

Three vessel movements were delayed at the Port of Richards Bay between Tuesday and Wednesday due to adverse weather conditions at the port.

Cape Town

On Friday, CTCT recorded three vessels at berth and none at anchor as more concerns regarding the number of ships calling the port arose this week. In the preceding 24 hours, stack occupancy for GP containers was recorded at 33%, reefers at 18%, and empties at 53%. In this period, the terminal handled 2 250 TEUs across the quay while 993 trucks were serviced on the landside. Crane LC4 remained out of commission this week as the auxiliary frame was anticipated to be replaced on Friday. The estimated time of return should be made available early next week.

The multi-purpose terminal recorded zero vessels at anchor and one at berth on Wednesday. In the 24 hours leading to Thursday, the terminal managed to service 44 external trucks at an undisclosed truck turnaround time on the landside. During the same period, 134 tons of general cargo were handled across the quay on the waterside. Stack occupancy was recorded at a very low 5% for GP containers, 1% for reefers, and 4% for empties during the same period, which is in complete contrast to the week before, and evidence of very low activity.

Durban

Pier 1 on Thursday recorded two vessels at berth, operated by five gangs, and two vessels at anchor. Stack occupancy was 67% for GP containers and remained undisclosed for reefers. During the same period, 2 762 imports were on hand, with 172 units having road stops and 130 unassigned. The terminal recorded 1 105 gate moves on the landside, with an undisclosed number of cancelled slots and 142 wasted. The truck turnaround time was recorded at ~100 minutes, with an average staging time of ~70 minutes.

Pier 2 had four vessels at berth and 16 at anchorage on Friday. In the preceding 24 hours, stack occupancy was 59% for GP containers and undisclosed for reefers. The terminal operated with nine gangs while moving 3 340 TEUs across the quay. During the same period, there were 1 948 gate moves on the landside with a truck turnaround time of ~135 minutes and a staging time of ~178 minutes. The number of gate moves during this period was well below target due to continuous equipment breakdowns on the landside. Of the landside gate moves, 1 248 (64%) were for imports and 700 (36%) for exports. Additionally, 337 rail import containers were on hand, with 192 moved by rail. Equipment challenges persisted, as the terminal had 59 straddle carriers in operation towards the end of the week. Despite the slight improvement, the terminal currently sits on an availability figure of approximately 52% when it comes to straddles and is currently approximately 26% below the number of machines that would be the minimum to satisfy industry demand.

Waterside congestion remains a concern at the port of Durban, with a total of 25 container vessels waiting at anchorage on Friday. As of 29 November 2023, the port remained on Linerlytica’s “Port Congestion Watch” with more than 35 800 TEUs stuck at outer anchorage.

Richards Bay

On Tuesday, Richards Bay recorded 18 vessels at anchor, with six vessels destined for DBT, eight destined for MPT, three destined for RBCT, and one for liquid. Additionally, 13 vessels were recorded on the berth, translating to five at DBT, five at MPT, two at RBCT, and one at the liquid bulk terminal. Two tugs and one helicopter were in operation for marine resources in the 24 hours leading to Thursday. During the same period, the coal terminal had two vessels at anchor and none at berth while handling 85 202 tons on the waterside and 21 trains on the landside. Additionally, three vessel movements were delayed due to adverse weather conditions.

Eastern Cape ports

NCT on Thursday recorded three vessels on the berth and two vessels at outer anchorage, with no vessels drifting. Marine resources of two tugs, two pilots, and one berthing gang were in operation in the 24 hours leading up to Friday. The ‘Tstitsikamma’ pilot boat, however, remained out of commission this week with no estimated time of return communicated. Stack occupancy was 50% for GP containers and undisclosed for reefers, as a total of 1 391 TEUs were processed, which did not meet operational targets, which is due mainly to the fact that the terminal went windbound between 10:50 and 23:10. Additionally, 462 trucks were serviced on the landside at a truck turnaround time of ~45 minutes. Furthermore, STS crane 1 was out of commission for the most significant part of the week, with OEM Liebherr on-site to execute the required repairs.

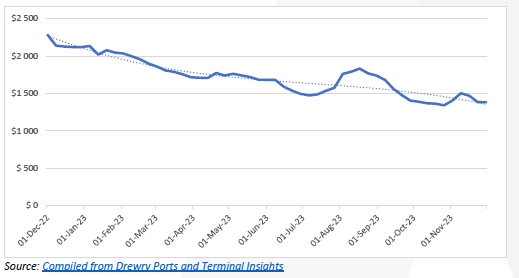

Global container freight rates and carrier profits

This week, average global spot rates were stable, as the “World Container Index” dropped a mere ↓0,1% (or $2) to $1 382 per 40-ft container20. The following figures show the last 12 months’ changes.

World Container Index assessed by Drewry (last 12 months, $ per 40 ft. container)

As the illustration shows, the composite index is now ↓40% lower compared to the same week last year and trending at lower levels (↓3%) compared to the average 2019 pre-pandemic rates. The year-to-date average composite index is $1 682 per 40ft container. For charter rates, the Harper Petersen Index (Harpex) is currently trending at 833 points, down by ↓0,1% (w/w) and ↓38% (y/y)21. Incidentally, Maersk is preparing for an early termination of its 2M partnership with MSC by reinforcing its fleet, most recently fixing two 13 100 TEU charters22. Lastly, Sea intelligence this week confirms that carrier earnings are down to pre-pandemic levels.

Source: BUSA

Wishing you the most wonderful festive break, safe travels, and a happy new year.

This week’s news was brought to you by:

FNB First Trade 360 – a digital logistics platform and Exporters Western Cape.