Welcome to another Logistics News Update.

There are several things happening in the world of logistics this month:

- Durban port: While catching up, the port is still experiencing delays due to split berthing, where vessels are forced to share berths. In some cases, this has led to vessels moving a day forward.

- Cape Town: After being windbound last week, the port is working hard to clear the backlog.

- Fuel prices: Expect an increase on Wednesday, March 6th. See the story below for details.

- Transnet: They have released their 2024/25 rate increases. (For your reference, I have attached the details). The average increase is around 7%, with reefer rates going up as much as 12%.

Disclaimer 1: Please note: All information presented in this post is based on reputable sources and has been referenced accordingly, this Logistic News is obligation free and if you wish to be removed from the mailing list, please reply to this mail requesting to be removed.

NEWS

Durban port Container Terminal 2 improves operations

01 Mar 2024 – by Staff reporter

Source: IOL

Durban port’s Container Terminal Pier 2 had reached stability as collaborative efforts to improve performance have borne fruit, Transnet Port Terminals announced on Thursday.

This comes after Transnet implemented its recovery plan which has included the presence of contracted original equipment manufacturer exports on-site who are helping to improve equipment reliability and availability over the next seven years.

Plans for the next 12 months include capital investment that will see the acquisition of 45 haulers, four reach stackers, and five empty container handlers, which will be commissioned for use in May this year. Approval and governance processes are also in progress for the acquisition of 20 straddle carriers that will be delivered by November 2024.

Durban Terminals managing executive Earle Peters said: “We will always have a few vessels at anchor for varying reasons. It’s the nature of busy and large terminal operations.”

He added that the terminal’s challenges had encouraged collaboration with employees, customers, academics, and original equipment manufacturers as the company worked towards sustainable solutions.

Source:FreightNews

More pain at the fuel pumps on Wednesday

01 Mar 2024 – by Staff reporter

The fuel price increases will take effect from Wednesday, 6 March 2024. Image: Brandon Bell/Getty Images

A steep fuel price increase will add more woes to the finances of cash-strapped consumers.

On Wednesday, South African motorists will have to fork out an extra R1.20 per litre for petrol, while the price of diesel is set to increase by R1.18 per litre.

In February, the fuel price increases were 75 cents per litre for petrol and between 70 cents and 73 cents per litre for diesel.

The March increase will result in 95ULP costing R24.44 per litre and 93ULP R24.10 per litre inland.

The AA attributes the increases to higher international product prices in addition to a weaker rand. “While the weaker rand is contributing to a small margin to the under-recovery and increase to prices expected next month, the overall picture still looks bleak, and consumers will feel the pinch,” the AA said.

National Treasury provided some relief in the 2024 Budget though, by not increasing the General Fuel Levy and the Road Accident Fund. These levies have been kept unchanged for the third consecutive year. The fuel price increases will take effect from Wednesday, 6 March 2024.

Source: MoneyWeb

Cape Town Container Terminal exceeds operational target

29 Feb 2024 – by Staff reporter

The Port of Cape Town is progressively addressing its personnel problems. Source: Logistics Capacity Assessments. Source: Freight News

The Cape Town Container Terminal (CTCT) exceeded its daily target of 2,302 twenty-foot equivalent units (TEUs) by 35% following the handling of 3,110 TEUs over 24 hours on Sunday.

CTCT said that the terminal had outperformed its target of 3,000 TEUs, which was last exceeded in November 2023.

Terminal management has been prioritising equipment availability and the streamlining of processes to boost operational efficiency and strengthen staff capacity to improve productivity.

CTCT has recruited an additional 81 employees since December 2023, with most enhancing operations and engineering departments as diesel mechanics, millwrights, haulier drivers and operations checkers, among others.

Acting Western Cape region managing executive Oscar Borchards said the terminal was also focusing on upskilling its teams.

“There are several strategic initiatives we have put in place to upskill employees as investing in our people is equally important”.

Source:FreightNews

Transnet concludes financial due diligence on ICTSI’s Durban Pier 2 deal

Part-privatisation of SA’s busiest container terminal moves a step closer.

01 Mar 2024 – by Staff reporter

Durban Container Terminal Pier 2 handles 72% of Durban Port’s traffic and 46% of SA’s import and export traffic. Image: Supplied. Source: IOL

State-owned logistics and port operator Transnet has concluded its financial due diligence into Philippines-based port operator International Container Terminal Services Inc (ICTSI) related to the Durban Container Terminal (DCT) Pier 2 deal. This clears the way for a contract signing – though subject to some non-financial processes required as part of the financial close.

Transnet confirmed this in its latest update on the deal on Friday.

In July 2023, ICTSI was appointed as the preferred bidder to form a 25-year joint venture with Transnet Port Terminals (TPT) to develop, upgrade and manage DCT Pier 2, which handles 72% of Durban’s port traffic and 46% of SA’s import and export traffic.

The involvement of private sector operators such as ICTSI is seen as crucial to the turnaround of Transnet ports. DCT Pier 2, which saw unprecedented backlogs of vessels at anchorage over the December period, has been able to reduce the backlogs by adding an extra work shift, new gantries and on-site parts and maintenance teams.

A new company will be formed to manage the operations at DCT Pier 2 in which Transnet will have majority ownership of 50% plus one share.

Source: MoneyWeb

PORTS

Weather and other delays:

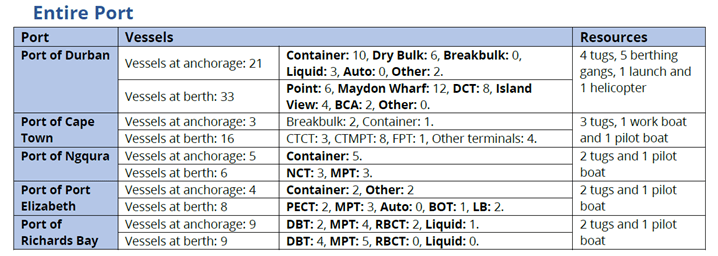

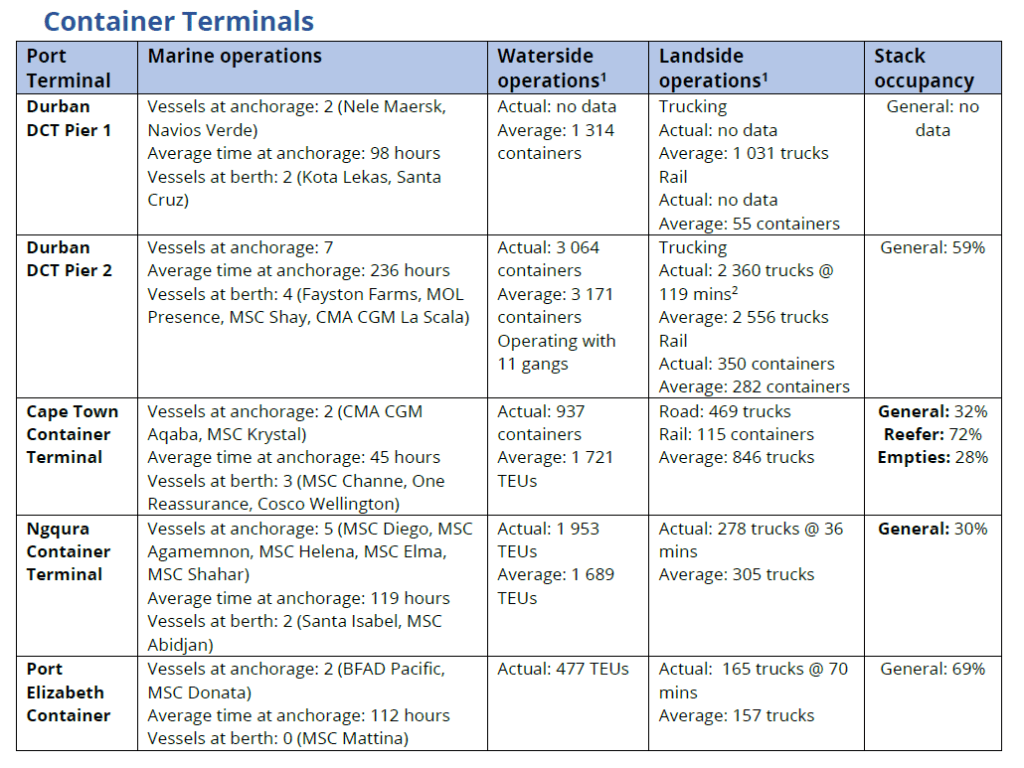

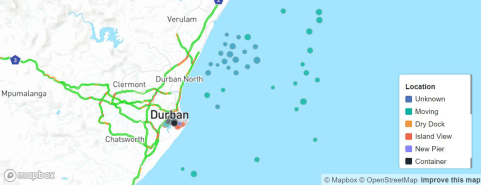

Average time at anchorage for container vessels as of 06:00 this morning: Durban: 200 hours (Point: 191 hours, Pier 1: 98 hours, Pier 2: 236 hours), Cape Town: 45 hours, Ngqura: 119 hours, Port Elizabeth: 112 hours. The figure below shows the current situation at our ports from a container vessel perspective (please note that these figures where necessary have been estimated to the best of our knowledge and abilities). The line indicates the average number of days vessels have been waiting at anchorage (in days), and the bar graphs represent the total volume of containers to be loaded and discharged for the vessels at anchorage at 06:00 this morning).

CT MPT are anticipating strong wind gusts as the day progresses, which may cause some operational delays. Additionally, CTCT went windbound from 06:00 to 09:00 yesterday morning and then again from 03:00 to around 07:20 this morning.

Both NCT and GCT experienced some operational delays due to strong winds and dense fog.

Three vessel movements deviated from their respective schedules over the latest 24 hours due to agents requesting time changes.

At the time of reporting this morning, Durban MPT had three cranes, eight reach stackers, one empty handler, six forklifts, and 18 ERFs in service. Additionally, the third crane is set to be utilised for training this week which will most likely result in a two-crane operation for the most significant part of the week.

DCT Pier 2 had 59 straddle carriers in service at the start of the morning shift. Additionally, south quay returned to two operational cranes this weekend as crane 522 made a welcome return. At north quay, crane 526 is out of commission but should return to service later today. At east quay, crane 534 is also out of service with no communicated ETR just yet.

Cranes 6, 7, and 8 at NCT are all out of commission. The ETR for crane 6 is scheduled for 15 March, while the other two cranes are anticipated to return around 22 March.

Truck turnaround times at GCT were very high over the latest 24 hours, largely due to equipment challenges.

Staging Areas Update:

Around midday, DCT Pier 2 had 64 trucks in overall staging and 135 in the respective terminal queues. AT the time of reporting, the staging areas at Pier 1 were flowing with no congestion reported within most of the blocks.

Cape Town

On Friday, CTCT recorded three vessels at berth and two at anchor as the terminal experienced another challenging week with respect to operational delays. In the preceding 24 hours to Friday, stack occupancy for GP containers was recorded at 29%, reefers at an elevated 91%, and empties at 26%. In this period, the terminal ceased its reefer intake but managed to move 1 091 containers across the quay. On the landside, 1 249 trucks were serviced, while 60 rail import and 48 rail export units were handled. At the start of the week, the terminal went windbound for more than 40 consecutive hours, which severely curtailed operational fluidity. As the week progressed, at least two vessel movements were delayed in Cape Town due to breakdowns on cranes LC3 and LC5. The breakdown of LC3 delayed the berthing of a vessel, while the breakdown of LC5 delayed a sailing.

Durban

Pier 1 on Wednesday recorded two vessels at berth, operated by five gangs, and three vessels at anchor. Stack occupancy was 59% for GP containers and remained undisclosed for reefers. During the same period, the terminal recorded 1 408 gate moves on the landside, with 423 cancelled slots and 49 wasted. On Monday, truck turnaround time was recorded at ~91 minutes, with an average staging time of ~47 minutes. Additionally, the terminal had 1 904 imports on hand, with 174 of these units having road stops and 107 units being unassigned. Earlier this week, a truck broke down in block E2, which rendered rows 54 to 65 inaccessible. Furthermore, the technical team in Durban is pushing to reintroduce crane QC2 to operations after a lengthy absence of one year. The crane is anticipated to return to service by the end of next week. Crane QC6 is destined for a lengthy outage due to an incident over the weekend.

Pier 2 had four vessels on berth and nine at anchorage on Friday. In the preceding 24 hours, stack occupancy was 56% for GP containers and undisclosed for reefers. The terminal operated with ten gangs while moving 2 337 containers across the quay. During the same period, there were 1 881 gate moves on the landside with a truck turnaround time of ~85 minutes and a staging time of ~21 minutes. Additionally, 527 rail containers were on hand, with 197 moved by rail. The terminal had a reported 58 straddles in operation. The current availability of straddle carriers in the terminal stands at approximately ~61%, which is around ↓24% below the minimum number required to meet industry demand and achieve acceptable terminal performance. Additionally, South Quay went down to one operational crane this week as another crane experienced a breakdown. This crane, however, is anticipated to return to service by Sunday evening 18:00.

TNPA in Durban experienced extensive challenges with their tugs earlier this week, as only two tugs were in service for the morning shift on Tuesday, and three of the tugs had engine problems. The technical team swiftly resolved these problems, as the port had four tugs operational before 09:00. In an attempt to alleviate the ongoing tug availability constraints, TNPA is injecting an R1 billion investment in its marine fleet renewal program through the acquisition of seven tugboats9. From this procured tug fleet, the Port of Durban has been allocated five tugboats, and two will go to the Port of East London.

Richards Bay

On Thursday, Richards Bay recorded eight vessels at anchor, comprising four bulk vessels, two coal carriers, one break bulk vessel, and one liquid bulk vessel. A further 13 vessels were recorded on the berth, consisting of five at DBT, six at MPT, two at RBCT, and none at the liquid bulk terminal. Two tugs, one pilot boat, and one helicopter were in operation for marine resources. During the same period, the coal terminal had one vessel at anchor and three at berth while handling 195 293 tons on the waterside. On the landside, 21 trains were serviced. Additionally, a vessel movement was delayed on Wednesday for at least two hours due to the helicopter being out of commission.

Eastern Cape ports

On Thursday, NCT recorded one vessel on the berth and two vessels at outer anchorage, with one vessel drifting. Marine resources of two tugs, one pilot boat, two pilots, and one berthing gang were in operation in the 24 hours leading up to Wednesday. The ‘Tsitsikamma’ pilot boat remains out of service; however, the port is utilising the outsourced pilot boat. Stack occupancy was 25% for GP containers, 15% for reefers, and 25% for reefer ground slots, as a total of 1 812 TEUs were processed on the waterside. Additionally, 150 trucks were serviced on the landside at a truck turnaround time of ~25 minutes. Cranes 6, 7, and 8 at the terminal are all out of commission. The ETR for crane 6 is scheduled for 15 March, while the other two cranes are anticipated to return around 22 March.

Global container freight rates and carrier profits

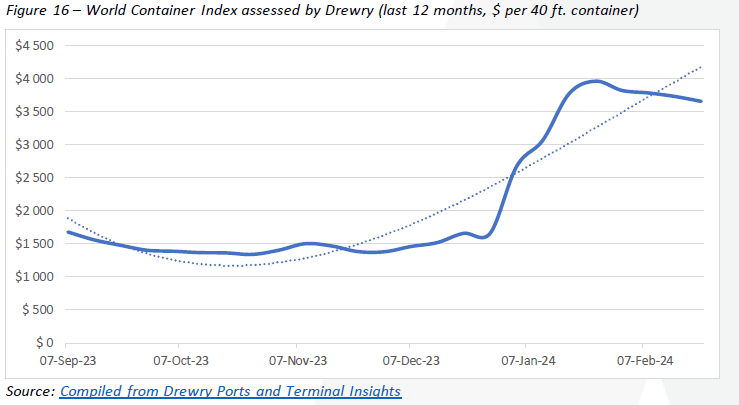

Continuing from the last couple of weeks’ decrease, global container rates dropped significantly this week, as the “World Container Index” is down by ↓4,5% (or $166) to $3 493 per 40-ft container19. The weekly changes mean that the composite index remains up by ↑88% compared to the same week last year and ↑146% higher than the average 2019 pre-pandemic rates of $1 420. The most significant changes this week came on the Shanghai – Rotterdam (↓7%) and Shanghai – Genoa (↓6%) trade lanes. The following figure shows the movement of the index in the last six months, with the influence of the Red Sea (and related) crisis evident:

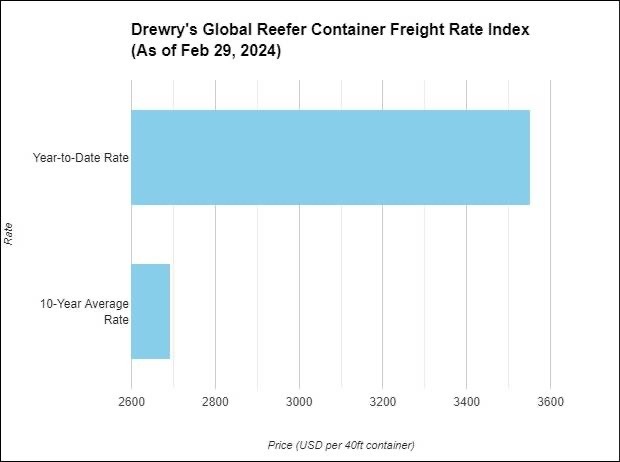

Drewry’s Global Reefer Container Freight Rate Index is a weighted average of pricing across the top 15 reefer-intensive deep-sea trades. As of February 29, 2024, the average composite index for the year-to-date is $3,553 per 40ft container. This is $859 higher than the 10-year average rate of $2,694

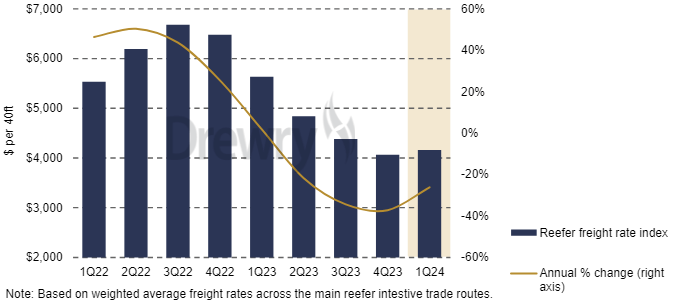

Reefer shipping rates rise to be temporary as excess capacity plugs gaps

The recent rise in reefer shipping rates is expected to prove short lived, as the trade adjusts to the rerouting of vessels and excess containership capacity is deployed to support longer transit times. While the subsequent re-routing of cargoes continues to add some delays and complexity in repositioning reefer equipment, this is not expected to have a long-term effect on freight rates. Drewry’s Global Reefer Container Freight Rate Index, a weighted average of freight rates across reefer intensive trade lanes, declined 37% in 4Q23 to a reading of $4,065 per 40ft container, but is estimated to have recovered moderately in the current quarter (see chart).

Ongoing violence in the Red Sea continues to cause shipping lines to reroute cargoes via the Cape of Good Hope, while record low water levels in the Panama Canal are simultaneously driving delays there. While the long-term outcome of events in the Middle East remains highly uncertain, the expectation is for reefer container freight rates to resume their downward trajectory over the course of this year.

A glut of newbuild container vessels entering the market this year is set to offset recent upward pressure on rates, with average reefer container freight rates set to revert to their long-term downward trend later this year. These are the main conclusions from Drewry’s recently published Reefer Shipping Forecaster report.

BUSA – SAAFF Summary

Ultimately, the ongoing efforts to address the backlog of vessels at Durban Port remain a focal point, as Transnet aimed to clear the backlog by the end of February. However, as of the current assessment, there are still 14 container vessels at anchorage, with nine waiting to berth at Pier 2. While the situation is more manageable, the ultimate goal is to streamline operations to ensure vessels can berth upon arrival and adhere to international schedules, which is critical for the shipping industry’s efficiency. This is also essential if our ports are ever to regain their status as first-tier ports instead of suffering from multiple transshipments. Furthermore, congestion surcharges implemented by shipping liners highlight persistent challenges at the port, with factors like weather and late vessel arrivals exacerbating the situation. Worth reiterating is the fact that South African ports have experienced a ↓21,5% loss in liner schedule connectivity in 2023, attributable to various factors, including Transnet’s problems and economic constraints. The latest recovery plan and 100-day rapid response initiative have certainly reduced the number of vessels at anchor, and stakeholders are expressing cautious optimism, notably with Michele Phillips’s permanent appointment as Transnet CEO, which the industry has widely welcomed. Nevertheless, challenges such as equipment constraints and infrastructure deficiencies persist, underscoring the need for sustained efforts to restore port operations to peak efficiency. Despite progress, achieving improved throughput volumes and enhancing port systems to boost the economy remain urgent and overarching goals.

This week’s news was brought to you by:

FNB First Trade 360 – a digital logistics platform an Exporters Western Cape