Welcome to another Logistics News Update.

South Africa’s Logistics Sector Under Mounting Pressure:

The South African logistics industry is grappling with escalating challenges, placing strain on businesses nationwide. Transnet, a central player in the sector, faces increasing scrutiny as its operational issues have been linked to business closures. Rising fuel costs compound these pressures, adding financial strain across the board. Meanwhile, the grapefruit export season has fallen short of expectations, with smaller fruit sizes and poor colour development reducing export volumes.

On the global front, shipping lines have imposed new weight-based surcharges as of November 1, 2024. For twenty-foot containers, fees start at $200 for weights over 23 tons, increasing to $400 and $600 at higher thresholds—non-negotiable and adding considerable cost for importers and exporters alike. Weather disruptions also continue to impact operations, with wind and rain causing delays at Durban and Cape Town ports. While Durban’s weather is expected to clear by mid-week, rain will resume by Thursday, and Cape Town will contend with ongoing winds averaging 32 kilometres per hour.

South Africa’s Citrus Exports Face Headwinds: – South African citrus exporters are facing hurdles in shipping their produce to the European Union (EU) due to strict phytosanitary regulations imposed by Spain. While Spain benefits from its geographical proximity to major European markets, South Africa must navigate complex logistical challenges and significant costs to meet EU standards. Read the story here

DID YOU KNOW

RED SEA CRISIS -How it affects you and why it does?

It is good to know what the Red Sea and crisis means to the shipping lines and mostly to our rates. The Red Sea crisis has significantly disrupted global shipping, primarily due to attacks by Yemen’s Houthi rebels on commercial vessels. These assaults have led many shipping companies to reroute their vessels around Africa’s Cape of Good Hope, bypassing the Suez Canal. This detour adds approximately 4,000 miles to each journey, resulting in increased transit times and higher operational costs. The crisis has also caused a substantial decline in Suez Canal traffic, with reports indicating a 66% reduction in the number of ships crossing through the canal since the onset of the disruptions. This shift has led to port congestion and capacity shortages, further straining global supply chains.

In response to the heightened risks, shipping companies have faced increased insurance premiums and have had to implement additional security measures. The International Maritime Organization (IMO) has emphasised the need for enhanced maritime security in the region to safeguard vital shipping lanes. The ongoing instability in the Red Sea underscores the vulnerability of global trade routes to geopolitical tensions and highlights the importance of international cooperation in ensuring the safety and security of maritime navigation.

Weather and Operational Delays Impact South African Ports

South African ports continue to face significant challenges due to adverse weather conditions and operational delays. As of this morning, container vessels at Durban port are experiencing average anchorage times of 67 hours, with Pier 1 at 25 hours and Pier 2 at a concerning 110 hours. Ngqura port is slightly better off with an average anchorage time of 37 hours. Additional delays were reported at Richards Bay due to adverse weather, while NCT and PECT faced setbacks from strong winds, power outages, and equipment breakdowns. Durban port saw disruptions to vessel movements caused by weather conditions and tug shortages. These ongoing delays are likely to impact supply chains and lead to increased costs for businesses.- Source: BUSA

Port Update

Port Operations Summary for the Week of 3 November 2024

- Durban: Windy conditions and equipment shortages continue to cause delays:

- Pier 1: Vessels face a delay of approximately 3-5 days, with heavy rainfall impacting straddle carrier performance.

- Pier 2: Delays extended to 8-12 days, worsened by low straddle carrier availability (around 57% operational).

- Durban Point: Experienced about 3 days of delays due to congestion and adverse weather.

- Cape Town: Strong winds resulted in about 40 operational hours lost, leading to delays:

- Cape Town Container Terminal (CTCT): Delays range from 3-5 days as three vessels await berthing.

- Multipurpose Terminal (MPT): Managed with minor delays, between 0-2 days

- Port Elizabeth: Windy conditions led to slight delays:

- Port Elizabeth Container Terminal (PECT): Delays are around 0-1 day.

- Ngqura Container Terminal (NCT): Delays increased to 2-3 days

Source: BUSA

Summary This week, port operations across Durban, Cape Town, and Port Elizabeth were significantly impacted by adverse weather conditions, leading to varying delays. Equipment shortages, particularly at Durban’s Pier 2, exacerbated delays, while Cape Town and Port Elizabeth faced limited disruptions.

NEWS

Transnet is responsible for business closures – CT harbour carriers

01 Nov 2024 – by Eugene Goddard

Gavin Kelly, CEO of the Road Freight AssociationCape Town Container Terminal is not functioning as it should. Source: TPT.

Cape Town harbour carriers are facing severe operational challenges due to Transnet’s mismanagement of the truck booking system and perceived favouritism towards other modes of transport.

The South Africa Transporters’ Alliance (SATA) has highlighted that several companies have already ceased operations, including notable names like TI Trucking and Max Logistics. The Navis N4 booking platform is plagued by connectivity issues, delayed slot appointments, and alleged manipulation, further exacerbating the situation.

SATA director Derick Organise expressed concern over Transnet’s prioritisation of waterside and rail operations, neglecting land-side activities. This imbalance has led to significant financial losses for transport companies and the potential collapse of businesses. Despite numerous attempts to engage with Transnet, the state-owned company has failed to address these pressing issues, leaving the industry in a precarious state.

The ongoing problems with people, productivity, and equipment at Transnet continue to hinder efficient operations and negatively impact the livelihoods of those involved in the transport sector..- Adapted from Source: FreighNews

TFR confirms investigation is under way into alleged solicitation of bribes

04 Nov 2024 – by Staff Reporter

Pink Lady cultivars such as Ruby Matilda have fetched more than R500 per carton in some parts of Europe and the UK.

At a time when Western Cape pear and apple producers should be celebrating the success of their export marketing campaigns, inefficiencies at the Port of Cape Town are costing them just shy of R1 billion annually.

During a recent visit to the facility, Dr Ivan Meyer, Western Cape minister of agriculture, economic development and tourism, expressed concern at “the worryingly slow pace” at which the Port of Cape Town’s turnaround strategy was happening, as it had “direct cost implications for the agricultural sector in the Western Cape”.

“While this figure is deeply worrying, it does not show the full extent of the loss to the agriculture sector because we are not calculating the lost opportunities of growing into new markets. We are not seen as a reliable supplier to the international market because we cannot guarantee delivery,” said Premier Alan Winde. Adapted Source: FreighNews Read the full story here

Weekly Snapshot

- Port Volumes: Container volumes surged by 30%, with 74,836 TEUs handled (34,218 imports and 40,618 exports). Rail cargo out of Durban reached 3,784 containers, a 47% increase from last week.

- Air Cargo: Volumes rose by 4%, with a total of 7,576 tons handled. Outbound cargo from OR Tambo Airport recorded its highest weekly volume since 2019.

- Cross-Border Delays: Average border crossing time at South African borders dropped to 13.6 hours (down 17%), while the SADC region averaged 4 hours (down 25%).

Key Observations

- Container Rates: Container shipping rates fell by 3.8%, now trading at $3,095 per 40-ft container. Meanwhile, charter rates remain stable.(Remember USA is the gauge – check locally for rates)

- Air Cargo Growth: African air cargo sales increased by 9% in September, led by e-commerce demand and high-tech shipments from Asia-Pacific.

Port Operations Summary

- Cape Town: Adverse weather, including around 40 hours lost to strong winds, affected Cape Town’s port efficiency. However, the terminal handled 1,837 trucks and executed 2,902 container moves on the quay.

- Durban: Severe equipment shortages and strong winds slowed operations. Pier 1 recorded 5,273 gate moves with an average turnaround time of 93 minutes, while Pier 2 achieved 9,501 gate moves, operating at roughly 57% straddle carrier capacity.

- Richards Bay: Persistent rain led to operational delays. Marine resources, including tugs and pilot boats, resumed service mid-week after initial disruptions.

Global Shipping Industry Impact

- Container Fleet Expansion: A surge in new vessels, adding nearly 1 million TEUs in Q2 alone, has contributed to “vessel bunching,” straining global port throughput.

- Freight Rates: Global rates saw a 3.8% increase, with notable rises on transatlantic routes, while Asia-to-North America rates declined due to overcapacity.

Air Cargo Performance

- ORTIA: OR Tambo International Airport recorded a 7% increase in inbound cargo, handling an average of 616,701 kg. Outbound volumes dipped slightly by 2% but remained robust compared to last year.

- Global Trends: Despite recent rate drops, international air cargo continued to grow, with significant demand from Asia-Pacific and Europe, particularly for high-tech and e-commerce goods.

Road Freight and Regional Updates

- Cross-Border Delays: Median border wait times at South African borders increased slightly to 14.1 hours, up 4% week-on-week. Severe congestion continued at Skilpadshek, with delays averaging over 16 hours.

Summary South Africa’s logistics network saw mixed performance, with gains in port and air volumes despite weather-related port disruptions and equipment shortages. Air cargo maintained strong demand, while cross-border efficiency showed slight improvement but still faced bottlenecks at select points like Skilpadshek.

Source: BUSA

Summary

Summary of Logistics Report

Container Terminals

- Throughput: Increased to 11,046 TEUs/day, up from 10,691 TEUs/day last week.

- Operational Challenges: Adverse weather, congestion, equipment breakdowns, and shortages hindered operations at various ports, especially Cape Town and Durban.

- Vessel Rerouting: The Santa Rita/244S and ONE Resilience/244S were rerouted to Cape Town due to adverse weather in Port Elizabeth.

Air Cargo

- ORTIA: Inbound and outbound cargo volumes increased, surpassing both last years and pre-pandemic levels.

- Global Air Cargo: Spot rates rose, driven by increases from Asia Pacific, Europe, and Central and South America.

- Industry Trends: E-commerce growth and capacity shortages are shaping the industry.

Cross-Border Road Freight

- Queue Times: Increased by around half an hour at South African and SADC borders.

- Border Post Delays: Chirundu OSBP, Groblersbrug, Kasumbalesa, and Santa Clara experienced significant delays.

- Other Factors: Skilpadshek border delays and Mozambique’s elections influenced transport flows.

Overall

The logistics sector continues to face challenges, primarily due to weather conditions and operational issues. While container throughput increased, port congestion and equipment shortages remain significant concerns. Air cargo is performing well, but capacity constraints and regulatory challenges persist. Cross-border road freight is experiencing longer queue times and border delays.

Key Focus: Private Sector Participation (PSP) is crucial for addressing infrastructure bottlenecks and operational inefficiencies. Transparency, financial stability for Transnet, and operational efficiency are essential for the success of PSP in South Africa’s logistics sector.

Global Container Freight Rates

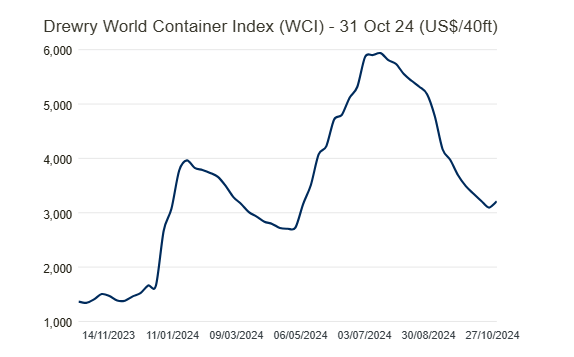

Drewry World Container Index (WCI)

World Container Index – 31 Oct – Drewry’s World Container Index increased 4% to $3,213 per 40ft container this week. While this is a significant drop from the pandemic peak of $10,377 in September 2021, it remains 118% higher than the pre-pandemic average of $1,420 in 2019. The year-to-date average for 2024 stands at $4,036, still above the 10-year average of $2,836, reflecting the impact of pandemic-driven inflation on shipping costs.

Market Update: Ocean Freight Rates on the Rise

As of Thursday, October 31, 2024, the Drewry World Container Index (WCI) composite climbed 4% to $3,213 per FEU. Though this is significantly below the pandemic peak of $10,377 (September 2021), it remains 126% above pre-pandemic levels in 2019. The year-to-date (YTD) average is $4,017 per FEU, marking a notable $1,178 increase above the 10-year average, influenced by the 2020-2022 Covid period.

Key Rate Movements:

- Shanghai to Genoa: +11% to $3,648 per FEU

- Shanghai to Rotterdam: +8% to $3,396 per FEU

- Shanghai to Los Angeles: +1% to $4,839 per FEU

- Los Angeles to Shanghai: +1% to $718 per FEU

- Rotterdam to Shanghai: -1% to $543 per FEU

With spot rates from China on the upswing following a period of decline, we anticipate further increases as the holiday season demand escalates.

Disclaimer: The information provided in this newsletter is based on reliable sources and has been carefully verified. This Logistics News is distributed free of charge. If you wish to unsubscribe from our mailing list, please reply to this email with “unsubscribe” in the subject line. Please note that all content is adapted or directly quoted from its original sources.

This week’s news was brought to you by:FNB First Trade 360 – a digital logistics platform and Exporters Western Cape

“This information contained herein is being made available for indicative purposes only and does not purport to be comprehensive as the information may have been obtained from publicly available sources that have not been verified by FirstRand Bank Limited (“FRB”) or any other person. No representation or warranty, express, implied or by omission, is or will be given by FRB, its affiliates or their respective directors, officers, employees, agents, advisers, representatives or any other person as to the adequacy, reasonableness, accuracy or completeness of this information. No responsibility or liability is accepted for the accuracy or sufficiency thereof, or for any errors, omissions or misstatements, negligent or otherwise, relating thereto. In particular, but without limitation, no representation or warranty, express or implied, is given as to the achievement or reasonableness of, and no reliance should be placed on, any projections, targets, estimates or forecasts and nothing contained herein should be, relied on as a promise or representation as to the past or future. FRB does not undertake any obligation to provide any additional information or to update the information contained herein or to correct any inaccuracies that may become apparent. The receipt of this information by any person is not to be taken as constituting the giving of any advice by FRB to any such person, nor to constitute such person a client of FRB.”