Welcome to another Logistics News Update.

South Africa’s freight and logistics sector continues to evolve, shaped by both challenges and progress in port operations.

February has been a tough month for most importers and exporters. At the ports, ongoing concerns from truckers over the booking system at Cape Town Container Terminal (CTCT) remain a pressing issue—though, in truth, both Durban and Cape Town are affected as truckers can’t get booking slots, that is a fact no matter what the press says, however, there seem to be two sides to this story (Cape Port): while congestion has improved, harbour carriers argue that inefficiencies still impact operations. Meanwhile, Durban’s port is undergoing a major equipment upgrade, signalling long-term improvements in efficiency and turnaround times.

Despite frustrations in certain areas, the overall outlook for South African ports is more positive than negative, with waiting times improving – a win for trade facilitation.

Beyond our borders, much attention has been on political shifts in the United States and their impact on South Africa’s trade relations, particularly with AGOA. While these global developments remain critical, it’s time to shift focus to Africa—the new frontier for trade and investment. With growing opportunities across the continent, businesses should look towards emerging markets, regional partnerships, and intra-Africa trade as key areas for expansion.

Donald Mackay recently remarked: “I will eat my hat if we get to the end of 2025 and South Africa still benefits from the African Growth and Opportunity Act (AGOA), the US legislation giving preferential access to the American market for most African states.” He went on to say that South Africa would fare better with a dedicated trade agreement. Watch this space.

In this week’s issue, we explore the latest developments, including demurrage and detention fees, updates from Freight News, and a closer look at how Africa’s logistics landscape is evolving. As always, staying informed and adaptable is key to navigating the ever-changing world of global trade.

Let’s Learn – Demurrage & Detention – Understanding Extra Costs in Shipping

In international trade, demurrage and detention are two of the most common yet misunderstood extra costs that can significantly impact profitability. These charges arise when cargo isn’t moved within the allocated free time, leading to penalties from shipping lines.

- Demurrage occurs when containers remain at the port beyond the free period before customs clearance or pickup.

- Detention is charged when a consignee holds onto a container longer than the allowed timeframe after pickup, before returning it empty. (late Turn-In)

To minimise these costs, businesses should plan ahead by ensuring:

- Proper documentation,

- Timely customs clearance, and

- Effective coordination with transport providers on delivery, missing a day may cost you.

Tracking shipment timelines closely and negotiating extended free time with shipping lines where possible can also help prevent unnecessary expenses. Proactive logistics management is key to avoiding demurrage and detention fees that can quickly add up.

Please note that the shipping lines has issued their rates for 2025, effective 1st of April

NEWS

Port of Cape Town harbour carrier update: TPT vs Sata

28th Feb 2025 – Eugene Goddard

Transnet has introduced a pilot truck booking system at Cape Town Container Terminal (CTCT), requiring transporters to arrive no earlier than 30 minutes before their scheduled slot. This initiative aims to streamline traffic flow, reduce congestion, and improve efficiency within the port precinct. Upon arrival, transporters must verify their truck registration and booking with security before gaining access. Full implementation of the system is expected by March, though it remains unclear whether the entry restrictions will apply at the outer perimeter or only at the terminal entrance.

Despite Transnet’s efforts, transporters argue that the system has not adequately addressed congestion issues. The SA Transporters Alliance (Sata) believes that enforcing stricter access control—barring trucks without slots from entering the port entirely—would better alleviate bottlenecks. Reports suggest that current conditions create a chaotic “free-for-all,” allowing excessive numbers of trucks into the port, ultimately delaying compliant operators and threatening long-standing businesses. During a meeting with Transnet Port Terminals (TPT) executives, one transporter highlighted how as many as 90 trucks enter the port precinct at once, making it difficult for legitimate carriers to access their allocated slots on time.

TPT defends the booking system, stating that similar models worldwide help manage truck arrivals, improve planning, and optimise available equipment. They maintain that the system has been refined over the years through collaboration with transporters, with ongoing discussions through weekly and monthly meetings. However, some transporters remain frustrated, feeling that these engagements have not led to meaningful improvements. Many argue that the persistent congestion is forcing companies out of business, calling for urgent intervention to ensure the system benefits all stakeholders in the logistics chain…

– Adapted from Source: FreightNews

Transnet’s Durban Container Terminal gears up for major equipment upgrade in 2025

28th Feb 2025 – by Hariesh Manaadiar

Transnet’s Durban Container Terminal (DCT) is set to undergo a significant equipment upgrade in 2025, with the introduction of over 100 new pieces of cargo-handling machinery. This substantial investment aims to address operational challenges and enhance the terminal’s efficiency, reinforcing its position as a pivotal hub in South Africa’s maritime industry.

The equipment upgrade is part of Transnet’s broader strategy to modernise its port facilities and improve service delivery. By integrating advanced machinery, DCT anticipates a boost in productivity, which is expected to attract increased cargo volumes and strengthen South Africa’s competitiveness in global trade.

This development aligns with Transnet’s ongoing efforts to implement institutional reforms and expand capacity across its operations. Such initiatives are crucial for accommodating future growth and ensuring the sustainability of the country’s logistics infrastructure.

Adapted from Source: Shipping & Freight

ON THE GROUND REPORT

Maersk issued a notice: Schedule Delays Impact Cape Town (due to weather) and Jebel Ali; Reefer Bookings Transferred to Minimise Disruptions.

Port Operations Summary: – Port Update:

SOUTH AFRICAN PORTS

DURBAN

The port experienced low wind speeds throughout the week.

- Pier 1: 0-day delay

- Pier 2: 0-day delay

- Durban Point: 0-3-day delay

CAPE TOWN

The port faced strong winds during the week, impacting operations.

- CTCT: 6–8 days delay due to previous wind disruptions

- MPT: No delays, with only minimal wind-related disruptions

PORT ELIZABETH

Windy conditions were reported last week

- PECT: 0 Days delay.

- NCT: 0 Day delay. Source: GoCommet & SACO

BUSA Cargo Movement Update – 2 March 2025

Port and Cargo Performance

- Port volumes declined by 9% this week, handling 72,284 TEUs.

- Air cargo volumes fell by 4%, with 5,898 tons moved.

- Durban port received over 100 new cargo-handling machines, improving efficiency.

- Cape Town port lost 40+ operational hours due to adverse weather.

- Rail cargo out of Durban dropped 13% to 2,607 containers.

- Border crossings remain a challenge: SADC transit times increased by 20%, while SA borders remained stable at 11.4 hours.

Trade and Logistics Developments

- South Africa recorded a R16.4 billion trade deficit in January, with exports down 6.4% and imports up 14.1%.

- Global schedule reliability remains low at 51.5%, with an average vessel delay of 5.32 days.

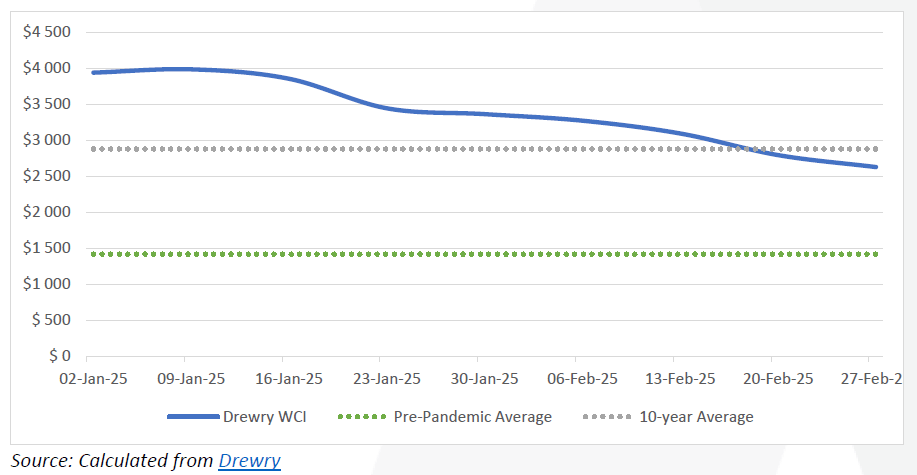

- Container spot rates dropped by 5.9%, now below the 10-year average.

- Air cargo demand grew 3.2% year-on-year, marking 18 consecutive months of growth.

Challenges and Improvements

- Load-shedding returned, affecting Maydon Wharf operations.

- Durban port still struggles with crew shortages and frequent equipment breakdowns.

- Global shipping remains volatile, with rate hikes expected in March despite weakening demand.

- Border delays and congestion persist, notably at Beitbridge, Groblersbrug, and Kasumbalesa, some taking up to three days to cross.

Looking Ahead

- Despite challenges, South Africa’s logistics sector shows resilience, with improvements in port equipment, rail reform, and operational efficiency.

- However, geopolitical uncertainties, including the potential end of AGOA, require businesses to consider diversified trade strategies. Source: BUSA

Global Freight Rates

- Global container spot rates have continued plummeting as Drewry’s “World Container Index” dropped another $166 to last week’s $300 and now trades at around $2 629 per 40-ft container13. The drop corresponds to ↓5,9% this week, which is a far cry from the start of the year when rates traded around $4 000/40ft. Two of the major East-West trades registered double-digit weekly changes, as Drewry expects rates to continue decreasing next week due to increased shipping capacity. Nevertheless, carriers maintain an optimistic outlook, aiming to implement general rate increases (GRIs) in March to stabilise rates.14 The following figure shows the drastic reduction in spot rates since the start of the year: Source: BUSA

Disclaimer: The information provided in this newsletter is based on reliable sources and has been carefully verified. This Logistics News is distributed free of charge. If you wish to unsubscribe from our mailing list, please reply to this email with “unsubscribe” in the subject line. Please note that all content is adapted or directly quoted from its original sources. We take no responsibility for any inaccurate reporting; we are only adapting the news for you.

This week’s news was brought to you by:

FNB First Trade 360 – a digital logistics platform and Exporters Western Cape.

“This information contained herein is being made available for indicative purposes only and does not purport to be comprehensive as the information may have been obtained from publicly available sources that have not been verified by FirstRand Bank Limited (“FRB”) or any other person. No representation or warranty, express, implied or by omission, is or will be given by FRB, its affiliates or their respective directors, officers, employees, agents, advisers, representatives or any other person as to the adequacy, reasonableness, accuracy or completeness of this information. No responsibility or liability is accepted for the accuracy or sufficiency thereof, or for any errors, omissions or misstatements, negligent or otherwise, relating thereto. In particular, but without limitation, no representation or warranty, express or implied, is given as to the achievement or reasonableness of, and no reliance should be placed on, any projections, targets, estimates or forecasts and nothing contained herein should be, relied on as a promise or representation as to the past or future. FRB does not undertake any obligation to provide any additional information or to update the information contained herein or to correct any inaccuracies that may become apparent. The receipt of this information by any person is not to be taken as constituting the giving of any advice by FRB to any such person, nor to constitute such person a client of FRB.”