Welcome to another Logistics News Update.

April brought its fair share of holidays, and while it may have disrupted routines and productivity, it also offered a chance to pause and regroup.

As we step into May, there are a few green shoots worth highlighting. The citrus season has kicked off, the expect to export 1711 million cartons of citrus, proof that not all the news is doom and gloom. Another such development is the encouraging engagement between South Africa and China. Chinese Ambassador Wu Peng recently expressed strong support for increased trade, particularly in agricultural and industrial goods — a welcome opportunity for local exporters. Our ports have also weathered the holiday season with solid performance, with no major disruptions aside from some weather delays. It’s a relief to be able to report on efficiency rather than setbacks. Looking ahead, all eyes are on 9 May 2025 as the deadline for a possible strike action — we remain hopeful for a constructive outcome that keeps our supply chains moving.

Let’s make May 2025 a turning point. While global headlines are dominated by trade tensions, particularly the Trump tariffs, it’s also a moment to rethink and reorient. These challenges can be the catalyst for exploring new corridors, strengthening underutilised partnerships, and opening markets we may have previously overlooked. Here’s to a month of resilience, opportunity, and smart logistics.

On the Ground

- Freight train derails outside Lydenburg, no injuries reported: Reports and images of a Transnet freight train that had derailed between Lydenburg and the Dullstroom/Belfast area have been going viral. So, cargo on rail will be delayed (containers) due to the fact only one line is open and if you have chosen rail, expect delays.

- Transnet seeks financing from Rio Tinto and Anglo American: South Africa’s state-owned logistics group, in the absence of fresh public funding, is seeking help from its major mining customers exporting from Richards Bay and Saldanha.

- Transnet Clears Durban Port Backlog: In a significant stride toward revitalising South Africa’s logistics landscape, Transnet has successfully cleared the backlog at Durban Port, marking a pivotal moment for the nation’s import, export, and trade investment prospects. Various Sources

🚨SARS Customs Enforces Stricter Compliance Measures: SARS Customs is stepping up enforcement as part of its Customs Modernisation Programme. Key areas of focus include:

- Advance Payment Notifications (APNs) and VAT number verification

- Tighter requirements for commercial invoices and supporting documents

- Immediate rejection of non-compliant declarations

- Warning letters and notices of suspension for unresolved queries or unfinalised provisional payments. Source: Clifford Evans – Freight News

Clearing agents’ risk having their licences suspended, which may severely affect day-to-day operations. All stakeholders are urged to act on any letters of intent without delay and to ensure full compliance with the updated requirements.

Let’s Learn: What Is a Certificate of Origin — and When Do You Need One?

Following last week’s topic on rules of origin, let’s focus on a critical document that proves your goods qualify for preferential trade — the Certificate of Origin.

What is it?

A Certificate of Origin (CO) is an official document that certifies the country in which your goods were manufactured. It’s issued by authorised bodies — such as your local chamber of commerce — and is essential when exporting under trade agreements like AGOA, SADC, or the EU–SA Trade Agreement.

Why is it important?

• It’s often a mandatory requirement for duty-free or reduced-tariff entry.

• Customs authorities in the destination country use it to verify eligibility under a trade agreement.

• Without it, your shipment could face delays, extra charges, or even rejection.

Types of Certificates of Origin

- Preferential CO – Used when trading under a trade agreement (e.g. AGOA, SADC, EPA).

- Non-preferential CO – Used when no agreement applies, but proof of origin is still required.

Tip for South African Exporters

Make sure your paperwork is accurate and complete. Even small mistakes can lead to rejections or penalties at customs.

💡 Tip: Create a checklist for every export that includes origin declarations, supporting invoices, and compliance documentation — and ensure your clearing agent signs off before dispatch. A properly issued Certificate of Origin is your passport to smoother, more cost-effective international trade.

NEWS

ICTSI defends partnership with Transnet as Maersk dispute resumes in court

1st May 2025 – by Babele Ginindza

Durban Pier 2 Terminal Project in Legal Limbo :The ongoing dispute between Transnet and global shipping group Maersk has once again taken centre stage in the KwaZulu-Natal High Court, threatening to derail much-needed upgrades to the Durban Container Terminal Pier 2. Despite International Container Terminal Services Inc. (ICTSI) being named the preferred bidder in April 2023, a court interdict — prompted by Maersk’s legal challenge — continues to delay the project’s rollout. ICTSI, a Philippines-based port operator, has reaffirmed its commitment to the partnership with Transnet and is urging swift resolution to avoid further harm to South Africa’s trade infrastructure.

ICTSI Defends Bid and Calls for Urgency: In a strong statement this week, ICTSI highlighted that it met and exceeded all bidding criteria, offering R12 billion for the concession and scoring a full 100% in the evaluation process — outperforming Maersk’s R9.2 billion offer and 83% score. The company emphasised its readiness to begin implementation immediately, noting its neutrality as a non-shipping-aligned operator that can service all lines equally. ICTSI raised concerns over the timing of Maersk’s challenge — nearly a year after the bid was awarded — calling it a delaying tactic with no basis in the published tender requirements.

Transnet Pushes Forward with Investments: While the legal process continues, Transnet is not standing still. Transnet Port Terminals CEO Jabu Mdaki confirmed ongoing infrastructure investments at Pier 2, including 20 new straddle carriers and four ship-to-shore cranes expected by the second half of 2025. Mdaki stressed that operational viability cannot be compromised, and maintaining the terminal’s functionality is vital to the country’s economy. Regardless of the court’s final decision, Transnet intends to ensure that Pier 2 remains fully equipped to meet the growing demands of South Africa’s import and export trade…

– Source: – Business Report – IOL

WEEKLY NEWS SNAPSHOT

- Container Market Outlook Bleaker for Rest of 2025 : The global container shipping industry is facing challenges due to overcapacity from a surge in new vessel deliveries, leading to downward pressure on freight rates.

- Maputo Port’s $165M Terminal Expansion Under Way: Maputo Port has initiated a $165 million expansion of its container terminal, aiming to accommodate post-Panamax vessels up to 366 meters in length, enhancing its capacity and competitiveness.

- Strong Figures Confirm Mozambique’s Economic Ascendancy: Despite political unrest following disputed elections, Mozambique’s economy showed resilience with a 5% growth last year, indicating a positive economic trajectory.

- Trump Tariffs Cast Shadow Over SA’s Soybean Exports: New tariffs imposed by the Trump administration are expected to increase competition in third markets, potentially impacting South Africa’s soybean export sector.

- South African Beef Exports Up 30% Year-on-Year: South Africa’s beef exports have increased by 30% compared to the previous year. However, continued efforts are needed to control animal diseases to sustain this momentum.

- National Carrier Plans New Routes Despite Constraints: South Africa’s national airline is planning to introduce new routes, leveraging its landing slots at London Heathrow, which it currently leases out but can reclaim with adequate notice.

- Chinese Ambassador Opens Door to Increased South African Trade: The Chinese ambassador held discussions with the CEO of the Citrus Growers’ Association and Fruit SA, indicating potential for increased trade between China and South Africa.

- Maersk Opens First Integrated Logistics Hub in Senegal: Maersk has inaugurated its first integrated logistics hub in Senegal, strategically located between the Port of Dakar and the city’s industrial area, to streamline operations.

- Ramaphosa Appoints Investment Adviser: President Ramaphosa has appointed a new investment adviser as part of the government’s economic reforms aimed at making South Africa more attractive to investors.

- Africa Aims for Greater Policy Influence at G20: African nations are seeking greater policy influence at the G20, focusing on mobilizing finance for a Just Energy Transition and ensuring debt sustainability for developing economies. Source: – FreightNews

Key Highlights from Last Week’s Discussions: Source: BUSA

Cargo and Trade Update – Week Ending 27 April 2025

- Merchant Shipping Bill — Industry Pushback Intensifies :The draft Bill aimed at revitalising domestic shipping through cabotage provisions is under fire. Critics warn it could add R14 billion to freight costs, strain port infrastructure, and limit foreign vessel access to only one local port per voyage — risking competitiveness and worsening current logistics bottlenecks.

- Global Trade Outlook — Container Throughput to Contract: Drewry forecasts a 1% drop in global container throughput for 2025 — only the third contraction since 1979. US trade policy uncertainty, oversupply in shipping, and weak demand are behind the downturn. Shippers are advised to revisit sourcing and inventory strategies.

- South African Ports — TNPA Data Shows Strong March Growth: March port volumes rose across the board:

• Containers ↑12% month-on-month

• Bulk cargo ↑15%

• Vehicle units ↑33%

These gains signal early recovery signs, though operational issues like weather and equipment breakdowns persist. - Port Volumes Dip Slightly Week-on-Week: Seaport container volumes dipped by 2% compared to the previous week. Cape Town suffered over 60 lost operational hours due to weather. Durban faced both equipment failures and weather-related delays.

- Air Cargo Softens: Air cargo volumes at OR Tambo fell 8% week-on-week. Inbound cargo was down 4%, outbound down 13%, with global rates also weakening due to Easter disruptions and tariff uncertainty.

- Border and Corridor Flows Mixed:

- • Lebombo Border Post: Truck volumes dropped to 1 361 vehicles/day (↓7%).

• Transit times: Cross-border queue time averaged 5.6 hours; total cost of delays across SADC corridors is estimated at R161 million — a 14% improvement from last week.

• SA border crossing times worsened, with median times rising to 12.5 hours (↑27%).

Port Operations Summary: – Port Update:

SOUTH AFRICAN PORTS

Durban

Significant improvement in terminal operations

- Pier 1: 0-3 days

- Pier 2: No delays

- Durban Point: 0-2 days delay

Cape Town

Transporters continue to struggle with bookings at the terminals; with slot allocations being delayed and gate openings tightly controlled.

- CTCT: 0–7 days delay

- MPT: No delay

Port Elizabeth

However, intermittent strong winds expected for weeks 16/17, with a risk of the terminals going windbound – this for both ports.

- PECT: no delays

- NCT: 0-2 days

Source: SACO * as reported 30/4/2025 but checked and all still reporting the same numbers

Global Freight Rates

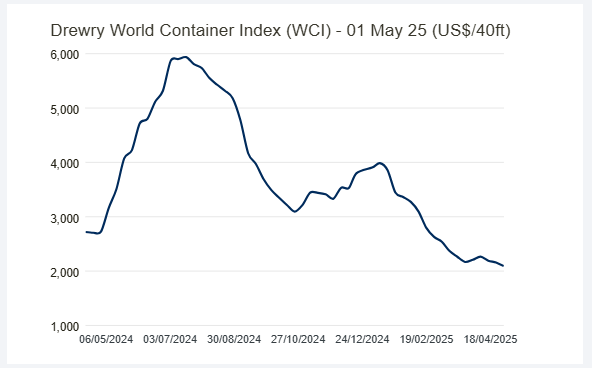

World Container Index –1st May 2025

As of May 1, 2025, Drewry’s World Container Index (WCI) decreased by 3% week-over-week, settling at $2,091 per 40-foot container. This figure is approximately 80% below the pandemic-era peak of $10,377 in September 2021 but remains about 47% higher than the pre-pandemic average of $1,420 in 2019. The decline in freight rates coincides with a broader softening in global container shipping demand. Drewry projects a 1% decline in global container port volume for 2025, largely attributed to the U.S. administration’s recent trade policies, including a 10% blanket tariff on imports from most countries and a 145% tariff on Chinese goods. These measures have led to significant shifts in trade patterns, with U.S. imports from China potentially falling by 40%, while imports from other countries may increase by up to 15%.

In response to these market conditions, carriers have been adjusting capacity through increased blank sailings. Between May 5 and June 8, 2025, 68 sailings have been cancelled across major East–West trade lanes, representing a 10% cancellation rate. These developments suggest continued volatility in freight rates and shipping demand in the near term. Shippers and logistics providers should closely monitor these trends and adjust their strategies accordingly.

– Source: Drewrey & Reuters

Disclaimer: The information provided in this newsletter is based on reliable sources and has been carefully verified. This Logistics News is distributed free of charge. If you wish to unsubscribe from our mailing list, please reply to this email with “unsubscribe” in the subject line. Please note that all content is adapted or directly quoted from its original sources. We take no responsibility for any inaccurate reporting; we are only adapting the news for you.

This week’s news was brought to you by:

FNB First Trade 360 – a digital logistics platform and Exporters Western Cape

“This information contained herein is being made available for indicative purposes only and does not purport to be comprehensive as the information may have been obtained from publicly available sources that have not been verified by FirstRand Bank Limited (“FRB”) or any other person. No representation or warranty, express, implied or by omission, is or will be given by FRB, its affiliates or their respective directors, officers, employees, agents, advisers, representatives or any other person as to the adequacy, reasonableness, accuracy or completeness of this information. No responsibility or liability is accepted for the accuracy or sufficiency thereof, or for any errors, omissions or misstatements, negligent or otherwise, relating thereto. In particular, but without limitation, no representation or warranty, express or implied, is given as to the achievement or reasonableness of, and no reliance should be placed on, any projections, targets, estimates or forecasts and nothing contained herein should be, relied on as a promise or representation as to the past or future. FRB does not undertake any obligation to provide any additional information or to update the information contained herein or to correct any inaccuracies that may become apparent. The receipt of this information by any person is not to be taken as constituting the giving of any advice by FRB to any such person, nor to constitute such person a client of FRB.”