Welcome to another Logistics News Update.

This August, we celebrate Women’s Month by recognising the strength, resilience, and leadership of women who shape trade, logistics, and business in South Africa.

The countdown is on. However, we think that our government has already conceded that no deal will happen by 7th August 2025. We’ll have to wait and see, but government representatives are already working on a plan of action to protect jobs and provide support in the short to medium term.

What do we know so far? We’ll know how much more Americans will pay for South African goods, cars, fruit, wine and more. These tariffs are a serious blow, but not the end of the road. South Africa has always adapted, and now we need to pivot fast: protect jobs, keep our industries competitive and open new markets.

The following do not have a 30% tariff – copper, pharmaceuticals, semiconductors, lumber articles, certain critical minerals, stainless steel scrap and energy and energy products. Source FreightNews

Let’s understand exactly what this is: There’s a lot of confusion about the tariffs the United States has just announced. Under a new executive order, most goods from South Africa will carry a 30 % duty when they arrive in the US. That means if you sell something for US$1, your American customer will pay about US$1.30 at customs. For cars and automotive parts, there is already a separate 25 % duty in place, so the total charge on those products could rise to about 55 %. The US government collects these charges at the point of entry, but they make our goods more expensive in that market.

The US is our second‑biggest trading partner. We sell vehicles, iron and steel, wine, and citrus there. Vehicles built in the Eastern Cape account for almost two-thirds of what we ship under AGOA. Citrus growers in the Western and Northern Cape also rely heavily on US buyers. Higher duties will make it harder for those sectors to compete and could lead to job losses. Pretoria has set up a support desk to help exporters find alternative markets, but realigning trade relationships takes time. Understanding the scale of these changes will help us plan our next steps.

Has our government done enough? In fairness to Pretoria, there have been attempts to defuse the situation. Trade Minister Parks Tau and his team spent months trying to cut a deal with Washington. They even put forward a package that included buying U.S. liquefied natural gas and investing in American industries. Source: reuters.com.President Cyril Ramaphosa has said that “all channels of communication remain open” and that South Africa’s negotiators stand ready to talk. Source: reuters.com. According to Reuters, the stumbling block has been on the American side; Mr Trump’s administration did not engage with the proposal, and relations have been strained by U.S. objections to our foreign policy and affirmative‑action laws. Source: reuters.com. So rather than a failure to negotiate, the impasse reflects broader political tensions.

The United States has officially imposed a 30% tariff on South African goods entering its market, following the collapse of trade talks. The tariffs take effect on 7 August. While the duty is charged to U.S. importers, the impact is clear: our products will cost 30% more in the U.S., making them far less competitive. This move hits two of South Africa’s biggest export sectors hardest, automotive and agriculture and the South African Reserve Bank has warned that more than 100,000 jobs could be at risk. For exporters, this isn’t just a headline. It means U.S. buyers may cut back or cancel orders, forcing businesses to rethink pricing and explore alternative markets quickly.

South Africa offered $3.3 billion in investment into the U.S. mining, steel and manufacturing industries, as well as reducing tariffs on poultry and food imports. Despite these offers, the U.S. did not respond before the 1 August deadline, and the tariff is now in place. Washington cited concerns about trade imbalances and rejected South Africa’s terms as insufficient.

Adding to the tension, U.S. negotiators raised concerns about South Africa’s Black Economic Empowerment (BEE) policies, saying they restrict foreign business access. South Africa pushed back, stating BEE is a cornerstone of its domestic economic transformation.

Turbulent times for the air cargo industry:- Global airfreight volumes and spot rates have dropped significantly amid rising U.S. trade tensions and tariffs. In June, volumes and chargeable weights between China, Hong Kong, and the U.S. fell sharply volumes down nearly 20% year-on-year and chargeable weight off by about 10%, pushing spot rates 17% below 2024 levels. Earlier declines of up to 60% in China–U.S. cargo flows and 50% reductions in e-commerce bookings have triggered a projected $22 billion revenue loss in the air cargo sector over the next three years.

Meanwhile, the latest TAC Index shows global airfreight rates remain broadly stable but with notable regional variation. On key trade lanes, outbound rates from Hong Kong and Shanghai to the U.S. and Europe fell year-on-year, while European rates from Frankfurt remain elevated. Mumbai and Vietnam show mixed movement rising to Europe but easing into the USA, suggesting fragmented regional trends. Overall, the industry is bracing for slower 2025 global growth in air cargo forecast at just 0.7% and carriers are shifting capacity to more resilient routes like Southeast Asia to adapt. Source: FreightNews

Let’s Learn: What is a Trade Deficit?

A trade deficit happens when a country imports more goods and services than it exports. In other words, it buys more from other countries than it sells to them. For example, if South Africa sells goods worth R100 billion to the U.S but buys goods worth R150 billion from the U.S, we have a trade deficit of R50 billion with the U.S. Why this matters is because countries like the U.S. see large trade deficits as a problem because they believe it hurts local industries and jobs. That’s why the U.S. government often uses tariffs to try to reduce imports and encourage buyers to purchase more locally made products instead.

Bottom line: A trade deficit isn’t always bad, but in politics and trade wars, it often drives big decisions like the new 30% tariff on South African goods.

NEWS

Trade tension: targeted countries offered a one-week reprieve

Source: FreightNews 1 August 2025

President Trump has granted a one‑week reprieve on a sweeping set of U.S. tariffs originally due to take effect on 1 August 2025. The deadline has now been pushed to 7 August, giving countries facing duties between 10% and 50% extra time to negotiate potential agreements that might reduce or delay the charges. South Africa is among the 69 targeted nations included in the reprieve window alongside allies like Canada, India and Japan. The steep duties cover a broad swathe of goods, including electronics, automotive parts, raw materials and agricultural products sectors vital to our export economy. Analysts describe the reprieve as a familiar U.S. negotiating move—“a shake‑the‑cage” tactic. Bold threats are issued, then briefly softened to test how trade partners respond and what concessions they might offer. It buys negotiation space but leaves all parties on edge. For South Africa, the week provides a critical opportunity. With 30% tariffs on the line for many goods, exporters need to move fast—either to strike last‑minute trade deals or to begin realigning supply chains. Failing that, the full duties kick in on 7 August, and uncertainty will shift swiftly to economic consequences. Source: Adapted from FreightNews

WEEKLY NEWS SNAPSHOT

- One-week reprieve on U.S. tariffs (1 Aug 2025): President Trump delayed new duties until 7 August, giving nearly 70 countries, including South Africa a short window for last-minute negotiations.

- SA still on edge over trade talks (30 Jul 2025): With the U.S. deadline looming, South Africa has yet to receive a formal template from Washington despite months of engagement.

- Tariffs could drag GDP down to 0.8% (29 Jul 2025): Economist Dawie Roodt warns the 30% tariff will hit competitiveness and slow growth further if implemented.

- Negotiations remain at a “sensitive stage” (28 Jul 2025): Trade Minister Parks Tau says Pretoria continues talks with Washington, but progress is slow, and details remain scarce.

- BEE and foreign policy tensions stall deal (31 Jul 2025): U.S. negotiators have raised objections to South Africa’s affirmative action and diplomatic positions, complicating trade discussions.

- PRRS dispute clouds agricultural exports (30 Jul 2025): SA maintains strict pork import controls over PRRS, pushing back on U.S. demands as citrus exports remain at risk.

- SA ports break 100,000 TEU barrier (27 Jul 2025): Container volumes hit levels not seen since 2017/18, driven by new equipment and extended shifts across major terminals.

- Cape Town records surge in reefer volumes (27 Jul 2025): Refrigerated container throughput jumped 64% year-on-year, signalling strong momentum for fruit exports despite tariff fears.

- Cross-border trade reforms gain traction (29 Jul 2025): PwC reports South Africa is leading AfCFTA customs modernisation efforts to cut delays and boost intra-African trade.

- Truck delays flare at Beitbridge (29 Jul 2025): Border congestion worsens as enforcement tightens following recent smuggling incidents, increasing pressure on road freight. Source: FreightNews

Key Highlights from Last Week’s Discussions – 27th July 2025

Source: BUSA, SAAFF, and global logistics data

1. SA Ports: Throughput Still Strong, Slight Dip Ahead

South African container volumes remain robust, with an average of 14 161 TEUs/day handled this week (↓2% w/w). Performance was driven by Durban Pier 2 (+5%), Ngqura (+5%), and smaller terminals (+15%).

- Next week forecast: Throughput expected to ease by 11% to ~12 581 TEUs.

- Challenges: Weather delays and ongoing equipment breakdowns continue across major ports.

- Rail recovery: Volumes on the Durban corridor rose sharply (+29%) after last week’s decline.

2. Trade Negotiations: Uncertainty Persists

- US–China: Tariff truce extended beyond August; tech rivalry remains a sticking point.

- US–EU: Partial rollback of tariffs on industrial and agricultural goods has boosted transatlantic flows.

- US–SA: No response yet to SA’s June proposal. The risk of 30% tariffs on automotive and agricultural exports remains imminent, posing significant risk for exporters.

3. Air Cargo: Rising Exports, Growing Tensions

- OR Tambo handled 4,1m kg inbound (↓3%) and 2,3m kg outbound (↑10%), showing strong export demand despite softer imports.

- Air cargo volumes are trending 6% above 2024 levels and 8% higher than pre-pandemic levels.

- Industry tension: ACSA’s R5,7 billion midfield cargo terminal project has caused friction with handlers operating without valid leases. Calls for independent regulatory oversight are mounting.

- Global: Tonnages dipped 2%, while rates rose slightly to $2,44/kg. Asia-Europe flows fell 6%, but Asia-US traffic rebounded by 3%.

4. Cross-Border and Road Freight

- Average delays at SA borders worsened to 11,4 hours (+20%), adding costs of roughly R170 million weekly to the industry.

- Lebombo corridor: Truck volumes fell 7% to 1 551 HGVs/day, while rail to Maputo improved slightly.

Global Snapshot

- Container trade: ↑1,4% (m/m) and ↑5,4% (y/y), but forecasts remain cautious.

- Spot rates: Down for the sixth straight week (–3,3%, now $2 517 per 40-ft container).

- Orderbook: Over 2,6 m TEU in new capacity added this year; congestion now impacts 8,1% of global fleet.

What This Means for You

- Exporters: With US tariff risks looming, plan for potential cost increases and longer lead times.

- Importers: Use the current dip in freight rates to negotiate favourable Q3 contracts.

- Air cargo users: Expect continued uncertainty in SA as ACSA’s plans unfold; factor this into routing and timing strategies.

- Cross-border operators: Build buffer time into schedules as delays across SA borders remain volatile.

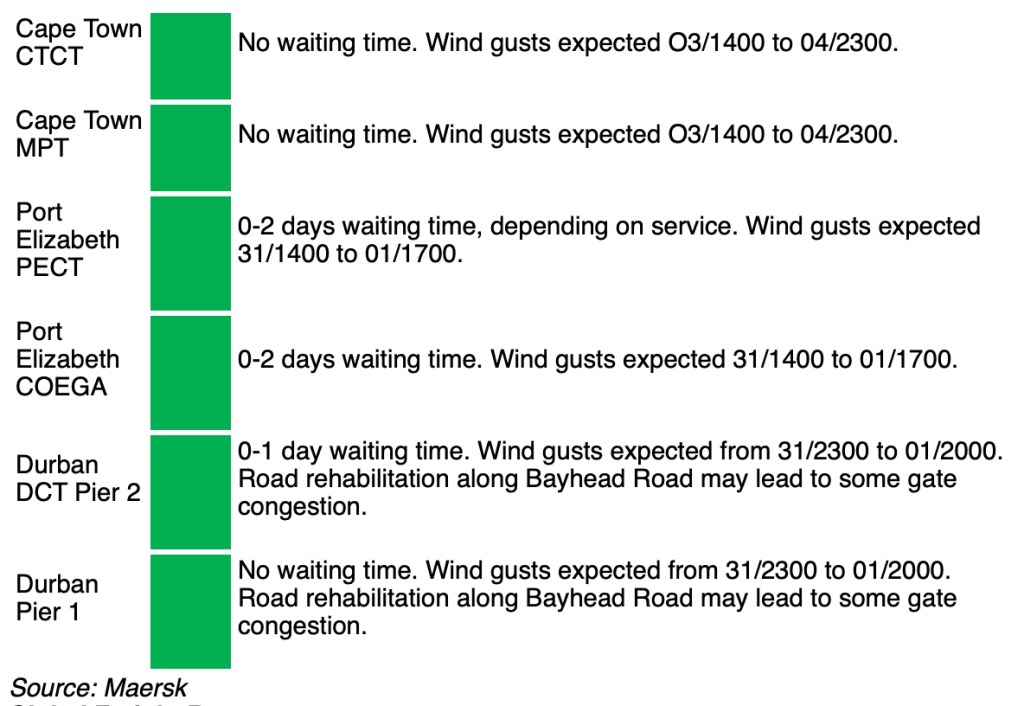

Port Operations Summary: – Port Update:

SOUTH AFRICAN PORTS: – Summary

Global Freight Rates

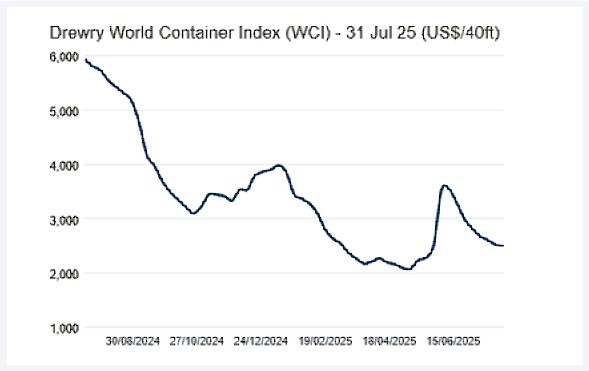

Weekly Container Rate Update – 31st July 2025

Drewry’s World Container Index decreased 1% to $2,499 per 40ft container this week.

Drewry Market Update

The World Container Index dipped just 1% this week, signalling stabilisation after months of volatility triggered by U.S. tariff announcements in April. Rates surged from May through early June, then plunged until mid-July before slowing their decline.

Transpacific routes saw minor drops, with Shanghai–Los Angeles down 2% to $2,632/FEU and Shanghai-New York down 2% to $4,135/FEU. With the pre-tariff shipping rush over and the U.S. pause on Chinese duties ending mid-August, carriers are cutting sailings to manage capacity.

Looking ahead, Drewry expects supply-demand to weaken in H2 2025, putting further pressure on spot rates. The extent of volatility will hinge on new U.S. tariff decisions and potential penalties on Chinese vessels. Source: Drewrey

Disclaimer: The information provided in this newsletter is based on reliable sources and has been carefully verified. This Logistics News is distributed free of charge. If you wish to unsubscribe from our mailing list, please reply to this email with “unsubscribe” in the subject line. Please note that all content is adapted or directly quoted from its original sources. We take no responsibility for any inaccurate reporting; we are only adapting the news for you.

This week’s news was brought to you by:

FNB First Trade 360 – a digital logistics platform and Exporters Western Cape

“This information contained herein is being made available for indicative purposes only and does not purport to be comprehensive as the information may have been obtained from publicly available sources that have not been verified by FirstRand Bank Limited (“FRB”) or any other person. No representation or warranty, express, implied or by omission, is or will be given by FRB, its affiliates or their respective directors, officers, employees, agents, advisers, representatives or any other person as to the adequacy, reasonableness, accuracy or completeness of this information. No responsibility or liability is accepted for the accuracy or sufficiency thereof, or for any errors, omissions or misstatements, negligent or otherwise, relating thereto. In particular, but without limitation, no representation or warranty, express or implied, is given as to the achievement or reasonableness of, and no reliance should be placed on, any projections, targets, estimates or forecasts and nothing contained herein should be, relied on as a promise or representation as to the past or future. FRB does not undertake any obligation to provide any additional information or to update the information contained herein or to correct any inaccuracies that may become apparent. The receipt of this information by any person is not to be taken as constituting the giving of any advice by FRB to any such person, nor to constitute such person a client of FRB.”