Welcome to another Logistics News Update.

This week’s newsletter dives into the recent challenges at Durban, Cape Town, and Port Elizabeth’s ports. We also cover aging equipment and procurement issues are causing delays, leading to a surge in air cargo freight. People needing urgent deliveries are facing higher costs to get their goods into South Africa.

Then we look at what is happening at other ports and how the delays are affecting your deliveries here in South Africa (see below). Interesting read under “On the ground” report.

Interesting read on port delays around the world, here are a few.

- Jebel Ali (3-4 days)

- Dammam (4-6 days)

- Colombo (1-2 days)

- Singapore (3-5 days)

- Port Kelang (2-3 days)

- Ningbo (1-2 days)

- Shanghai (1-2 days)

- USA (Avr. 7 days)

On The Ground Update:

It seems that Portnet take one step forward and three steps back, this past week has been a challenge, vessels that were in and due on the 28th have moved out to the 1st of May, then it has now moved to 9th of May. Clients are frustrated with the inconsistency, the Port have even asked scientist to come and help them, but we know that the equipment failure is the problem. MSC are still dropping containers in P.E. and because there are so many containers, now there aren’t transporters to move it and some of them are charging round trip rates to collect and deliver.

Transporters are not getting bookings, so every four hours, they open the booking for 10 slots, and this is taken as quick as it is opened leaving truckers frustrated and client more frustrated at not being able to get their cargo.

Day 143 of the Red Sea crisis

Despite the speech from the Houthies’ leader to escalate the attacks by broadening the geographic area as well as also broaden the targeted ships to any that might call Israeli ports, we have seen no new attacks yesterday. All in all, a quiet weekend in terms of physical attacks. However, the Turkish ministry of trade announced a suspension of all trade with Israel on Friday. In that connection Maersk issued an advisory yesterday suspending all cargo movements between Turkey and Israel (both directions). They also suspend transhipment of all Israel-related cargo from 3rd countries in Turkish ports. They also suspend empty containers to/from Israel in relation to Turkey. at of the time of this update the other global carriers had not published any advisories as to this matter on their websites – although they might have issued information to customers directly affected. Zim also do not presently have a customer advisory pertaining to this; however, Zim has a significant number of services calling Turkish ports.

Source: Lars Jensen (industry expert)

Port Update: Delays and Schedule Changes – Here’s a quick breakdown by ports:

Durban:

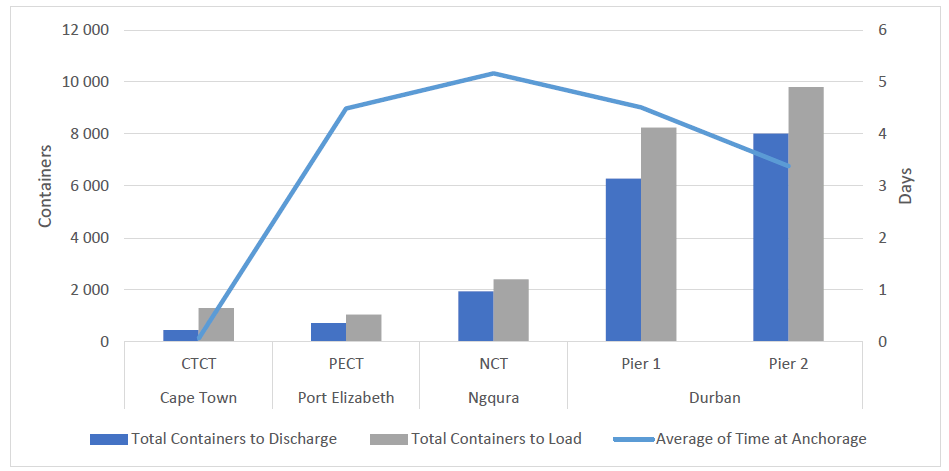

Pier 1: Expect delays between 5-6 days.

Pier 2: Significant delays of up to 21 days are expected.

Cape Town:

Delays of around 5 days are expected for both CTCT and MPT terminals.

Port Elizabeth:

Both PECT and NCT terminals are experiencing minimal delays of around 3 days.

Overall:

The biggest delays are currently at Durban’s Pier 2.

Durban’s Pier 1 and Cape Town’s terminals are experiencing moderate delays.

Port Elizabeth’s terminals have the least delays out of the three ports listed.

Source: Adapted from SACO

Disclaimer 1: Please note: All information presented in this post is based on reputable sources and has been referenced accordingly, this Logistic News is obligation free and if you wish to be removed from the mailing list, please reply to this mail requesting to be removed.

NEWS

Also read: Container Line Reliability Improves

Learn more about the air cargo boom and the port challenges in this week’s story here Air cargo sector continues to soar.

SA manufacturing activity rebounds

03 May 2024 – by Staff reporter

Source: Unsplashed, Clayton Cardinalli.

South Africa’s manufacturing activity rebounded in April on the back of a full month of no load-shedding and possibly due to an improvement in port congestion.

According to the Bureau for Economic Research’s Weekly Review, the seasonally adjusted Absa Manufacturing Purchasing Managers Index (PMI) surged to 54 in April, up from 49.2 in March, signalling a renewed expansion in factory activity.

“The rebound comes from improved business activity, while better domestic demand filtered through to higher new sales orders. A full month of no load-shedding was likely positive for sustained business activity. The continued efforts to solve the port issues may have also had a positive impact,” the BER economists said.

However, cost pressure due to rising fuel prices remains a challenge. Petrol prices increased by 37 cents in May to the highest level since October 2023, while diesel prices, an important input cost for manufacturers, decreased by 30-36 cents, but still remain high.

“Domestic new car sales surprisingly ticked up by 2.2% year-on-year (y-o-y) following eight straight months of declines. More trading days relative to April 2023 may have helped with the increase,” the economists noted.

Source: Freight News

Ageing equipment hampers productivity

03 May 2024 – by Liesl Venter

Addressing the ongoing equipment issues at South African ports is crucial for the competitiveness of the sea freight sector.

Neglect and mismanagement of funds have led to significant levels of capital expenditure.

View Latest Feature – Sea Freight – Click here!

This poses a serious challenge in catching up with the necessary improvements.

While borrowing remains an option, it is adding to the country’s escalating debt levels.

Peter Besnard, CEO of the South African Association of Ship Operators and Agents (Saasoa), highlights the detrimental effects of ageing equipment and inadequate maintenance at South African ports.

According to him, this issue severely hampers productivity and the timely turnaround of vessels.

Moreover, there are ongoing challenges in terms of marine resources such as tugs, pilot boats, helicopters, and pilots, particularly at the ports of Durban and Richards Bay.

Source: Freight News

PORTS

Weather and other delays:

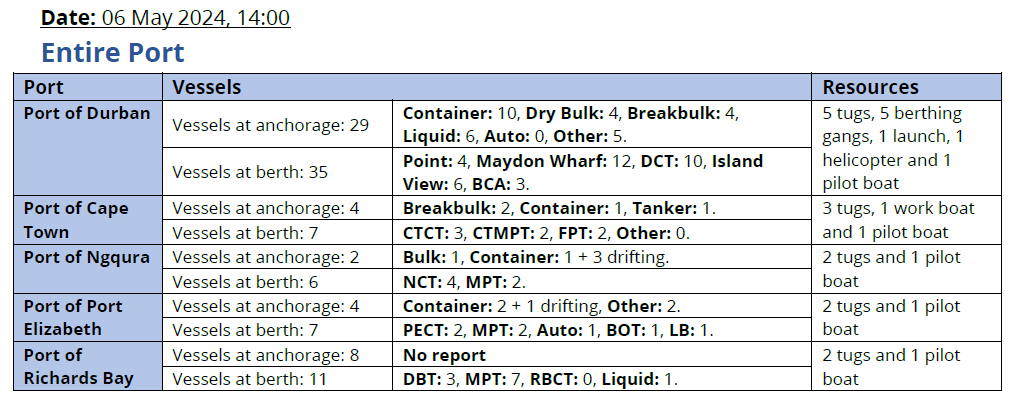

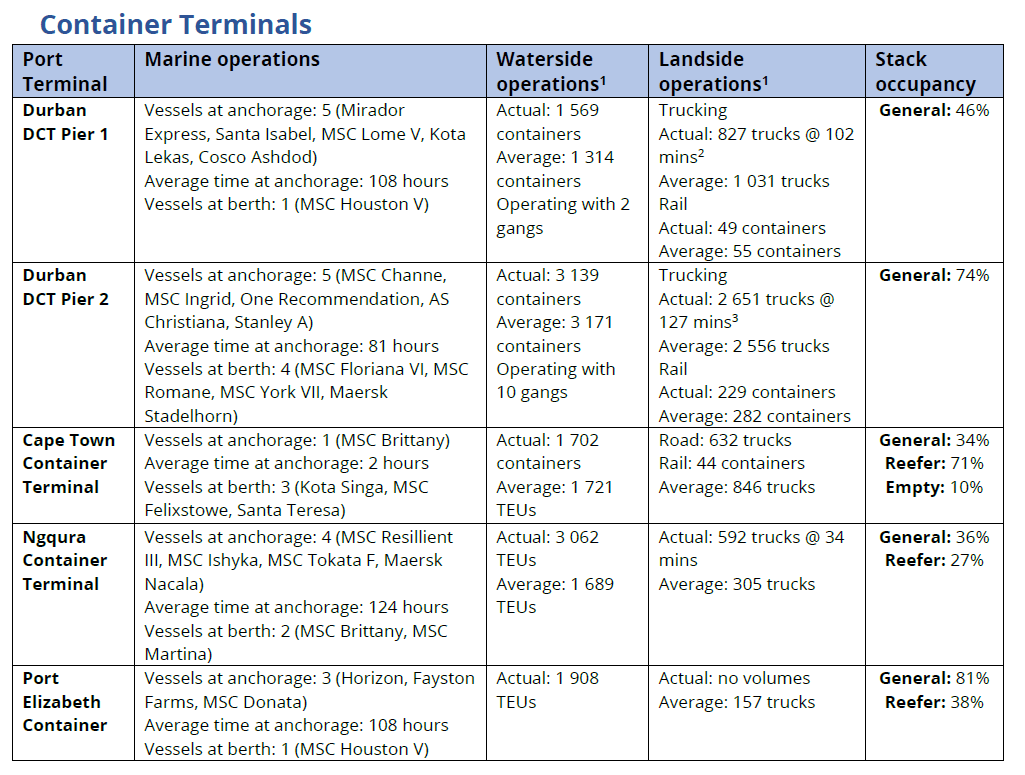

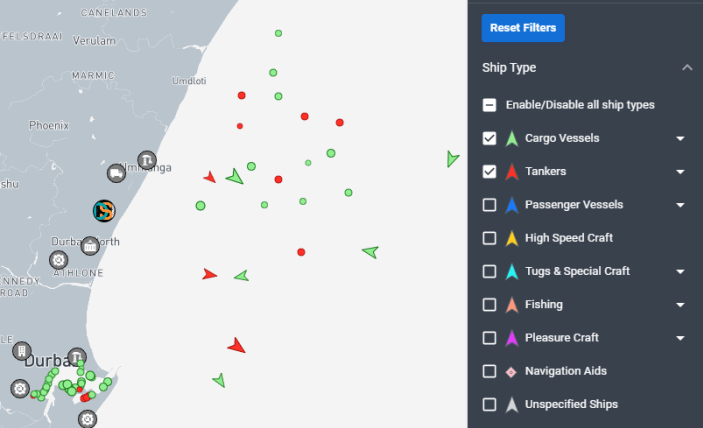

- Average time at anchorage for container vessels as of 06:00 this morning: Durban: 95 hours (Pier1: 108 hours, Pier 2: 81 hours), Cape Town: 2 hours, Ngqura: 124 hours, Port Elizabeth: 108 hours. The figure below shows the current situation at our ports from a container vessel perspective (please note that these figures where necessary have been estimated to the best of our knowledge and abilities). The line indicates the average number of days vessels have been waiting at anchorage (in days), and the bar graphs represent the total volume of containers to be loaded and discharged for the vessels at anchorage at 06:00 this morning).

- CTCT reported just under 5 hours of operational delays at berth 601 due to ranging yesterday, due to crane LC1 obstructing the shore tensioner.

- Maydon Wharf experienced operational delays

Equipment Availability:

- Durban MPT reported equipment availability as follows: three cranes, seven reach stackers, and one empty handler. The fourth crane is anticipated to return to service by the end of the month.

- At the time of reporting, CTCT was operating with seven STS cranes, 26 RTG’s, and 42 haulers.

- The Moore Master at NCT is expected back in service around 15 May. Additionally, STS crane 5 is currently out of commission and expected back in service by tomorrow, where after crane 7 will be taken out of service.

- The new haulers for Pier 1 arrived at the port, but some paperwork and modifications need to be done on the machines before they can be introduced to operations.

Ports Update

Cape Town

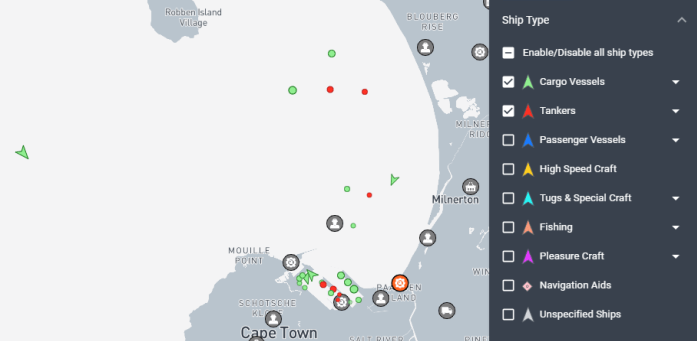

On Friday, CTCT recorded three vessels at berth and two at anchor as dense fog and union engagements hampered operational performance at the terminal. The terminal handled 1 503 container moves on the waterside between Thursday and Friday. On the landside, between Monday and Wednesday, the terminal managed to service 2 350 trucks, translating to an average of 783 trucks per day, while handling 116 rail units. At the start of the week, stack occupancy for GP containers was recorded at 34%, reefers at 42%, and empties at 31%. Towards the end of the week, the terminal operated with seven STS cranes, 25 RTGs, and 42 hauliers. Cranes LC1 and LC5 remained out of commission this week, with no clear ETR available yet.

The multi-purpose terminal recorded one vessel at anchor but none at berth on Thursday. In the preceding 24 hours, the terminal managed to service 75 external trucks at an undisclosed truck turnaround time on the landside. During the same period, CTMPT managed to move 83 TEUs across the quay on the waterside, with the berthed vessel completing operations. Stack occupancy was recorded as very low at 8% for GP containers, 1% for reefers, and 6% for empties. The terminal lost several operational hours throughout the week due to dense fog. At the start of the week, two cranes, two straddles, two reach stackers, ten hauliers, and two forklifts were in operation.

During the week of 22 to 28 April 2024, the FPT terminal serviced seven vessels comprising two multi-purpose vessels, one containing steel, two container vessels, one dry bulk-, and one break bulk vessel. Berth occupancy during this period was recorded at 68%. During the week, 2 193 TEUs were handled at ~ nine containers per hour, 4 197 tons of steel at ~130 tons per hour, and 3 694 pallets of fruit were handled at ~33 pallets per hour. Additionally, 9 394 tons of dry bulk was handled at ~219 tons per hour, and 216 tons of general break bulk cargo was handled at ~54 tons per hour. FPT planned to handle nine vessels between 29 April and 05 May, with another seven planned between 06 and 12 May. Dense fog, strong winds, and crane breakdowns accounted for most of the delays at the terminal this week.

At midday on Friday, eight vessels were waiting outside at anchorage in Cape Town, with the following snapshot of the port and vessels waiting to berth:

Figure 8 – Cape Town vessel view (per vessel group)

Durban

For the most significant part of Thursday, Pier 1 recorded one vessel at berth, operated by four gangs, and four vessels at anchor. Due to dredging operations, one of the berths was out of commission most of the day. Stack occupancy was 51% for GP containers and remained undisclosed for reefers. Between Monday and Wednesday, the terminal executed 3 074 gate moves on the landside at an undisclosed truck turnaround time and staging time. By midweek, the terminal had 1 511 imports on hand, with approximately 230 unassigned.

Pier 2 had four vessels on berth and four at anchorage on Thursday as equipment breakdowns and shortages impacted the terminal throughout the week. In the 24 hours before Thursday, stack occupancy was 59% for GP containers and remained undisclosed for reefer ground slots. The terminal operated with 11 gangs while moving 3 382 containers across the quay. During the same period, there were 2 301 gate moves on the landside at a truck turnaround time of ~148 minutes. Additionally, 232 rail containers were on hand, with 224 units moved by rail. The terminal reported an average of 45 straddles (↓11, w/w) in operation, translating to an availability figure of approximately 47%, around ↓41% below the minimum number required to meet industry demand and achieve acceptable terminal performance.

Durban’s MPT terminal recorded three vessels at berth on Tuesday and one at outer anchorage. On the waterside, 455 containers and 2 241 break-bulk tons were moved across the quay, while 212 container road slots and 29 breakbulk RMTs carrying 911 tons were serviced on the landside. Stack occupancy for breakbulk was recorded at 48% and 38% for containers. During the same period, two cranes, eight reach stackers, one empty handler, seven forklifts, and 20 ERFs were in operation. Crane 01 at the terminal was expected to return to service on 02 May, while crane 03 is still anticipated to return on 15 May.

On Tuesday, the Maydon Wharf MPT had one vessel on berth and zero at outer anchorage as 1 124 volumes were handled on the waterside. On the landside, 12 trucks conveying 429 tons were serviced. During the same period, the Agri-bulk facility had no vessels on berth with the next vessel anticipated to arrive on 15 May. As a result, no volumes were handled on either the waterside or the landside.

A queue of vessels waiting outside Durban remains. At midday on Friday, an improved four vessels were waiting for Pier 2, four for Pier 1, and none for Point terminal, with the following snapshot of the port and vessels waiting to berth:

Richards Bay

On Thursday, Richards Bay recorded nine vessels at anchor, while ten vessels were berthed, consisting of four at DBT, four at MPT, one at RBCT, and one at the liquid-bulk terminal. Two tugs, one pilot boat, and one helicopter were in operation for marine resources. During the same period, the coal terminal had five vessels at anchor and only one on the berth while handling a disappointingly low 67 947 tons on the waterside. On the landside, 14 trains were serviced. As part of the port’s recovery plan, TFR has ramped up the number of GF-class coal trains moving cargo to the Port from 21 to 28 to ease the congestion experienced at the port.

Eastern Cape ports

On Tuesday, NCT recorded two vessels on the berth and one at the outer anchorage, with two drifting. Marine resources of two tugs, one pilot boat, two pilots, and one berthing gang were in operation 24 hours before Wednesday. Stack occupancy was 31% for GP containers, 47% for reefers, and 82% for reefer ground slots, as a total of 1 185 TEUs were processed on the waterside. Additionally, 254 trucks were serviced on the landside at a truck turnaround time of ~37 minutes. Towards the end of the week, the terminal experienced delays of up to six hours due to strong winds.

No reports were received for either the Ports of Port Elizabeth or East London this week

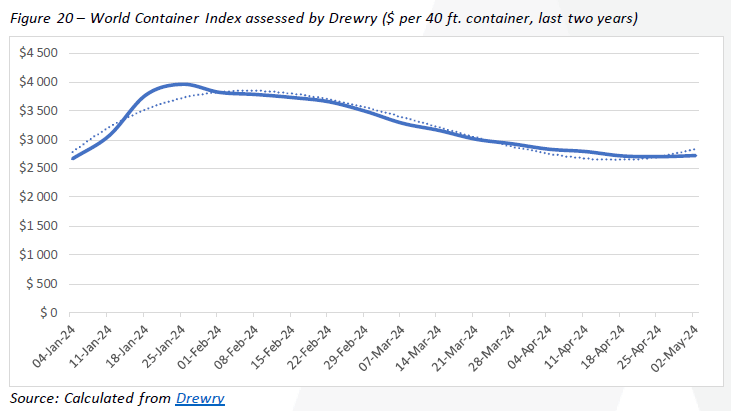

Global Container Freight Rates

Global container trade statistics – May

Schedule reliability impacted by Red Sea divergence

Widespread container shipping detours to avoid Houthi attacks in the Red Sea are expected to extend well into the second half of this year and maybe into 2025. During a conference call this week, various possibilities were discussed by a well-known analyst, the CEO of the world’s No. 5 carrier, and an executive at one of the world’s largest freight forwarders. They deliberated on the duration ships would continue circumnavigating southern Africa instead of utilising the faster route through the Suez Canal and the Red Sea. This route diversion has been prompted by a series of attacks on merchant ships since mid-November, totalling around 65 incidents, according to one account, leading to a reduction of about half in cargo shipping traffic in the region.

Their collective viewpoint was that the duration of this circumnavigation strategy heavily relies on resolving geopolitical and military conflicts in the area. Alan Murphy, the founder of Sea-Intelligence, remarked that shipping lines wouldn’t resume routing through the Suez Canal until safety is assured. Even if the conflict ceased abruptly, the resumption of Suez transits wouldn’t occur immediately. The following side-by-side graph shows Sea Intelligence’s analysis for March:

The containership fleet capacity currently stands at 29,37 million TEU and will reach 30 million TEU by the end of June. Although the nominal fleet growth has reached ↑10% (y/y), effective capacity on the four main East-West trades has grown by only ↑3% this year as the vessel diversions to the Cape route due to the Red Sea crisis have absorbed most of the new capacity. At a global level, effective capacity on all 33 inter-regional linehaul routes tracked by Linerlytica has shrunk by ↓4% (y/y), with reduced capacity deployed on the Red Sea/Middle East/Med routes dragging down the overall average despite the growth in the four main E-W trades, as illustrated:

Stability is evident across the market, as most trade lanes have not moved by more than ~3% in the last few weeks. The composite index remains up by ↑55% compared to the same week last year and is ↑92% higher than the 2019 pre-pandemic rates of $1 420. In the charter market, the rate climbed rapidly this week, as the Harper Petersen Index (Harpex) is currently trending at 1 290 points, up by ↑3,0% (w/w) and up by ↑6% (y/y) versus this time last year21. Looking ahead, freight rates are expected to remain firm, with another round of hikes planned in mid-May as container equipment and prompt vessels remain in short supply22New container boxes produced in China are fully booked until the end of June, while charter rates are rising sharply for ships above 1 700 TEU. The vessel shortage has also forced COSCO to temporarily withdraw from one of OCEAN Alliance’s Asia-North Europe strings. Still, freight futures retreated at the start of this week on potential Hamas-Israel ceasefire risks.

BUSA-SAAFF Summary

In summary, our ports and air cargo industries have improved somewhat in the last couple of weeks; however, the downward trend of several high-frequency metrics this week indicates that the industry is still a long way off from any sustainable recovery. It goes without saying that port efficiency must continue to improve, and one of the keys to such improvement will be some urgent investment in modern assets. Despite ongoing disruptions (especially declining infrastructure quality, unreliable power supply, and equipment shortages), we must not forget that South Africa’s ports remain crucial gateways for trade, with Durban still Africa’s busiest port. Furthermore, South Africa’s ports serve as conduits for trade with southern African neighbours and global hubs for traffic to and from various continents. Ultimately, South Africa’s ports remain vital nodes in the global supply chain, so it is up to all stakeholders to continue with ongoing efforts to improve efficiency, increase throughput and attract more traffic.

Source: BUSA

This week’s news was brought to you by:

FNB First Trade 360 – a digital logistics platform and Exporters Western Cape