Welcome to another Logistics News Update.

As we count down to a well-deserved long weekend and celebrate Woman’s Day, let’s take a moment to appreciate the incredible women in our lives.

Adding to the good news, a slight relief is on the way with a petrol price decrease of 15c and diesel down by 28c this Wednesday. Let’s make the most of this short week!

However, it’s not all smooth sailing. The ongoing chaos at Durban’s Container Terminal is creating significant challenges for Harbour Carriers and, ultimately, for you. Equipment breakdowns, a dysfunctional booking system, and a lack of transparency from Transnet have culminated in a perfect storm of inefficiency. Transporters are facing delayed collections due to daily transaction limits, while shipping lines seem to enjoy preferential booking treatment. This has left frustrated importers unable to access their goods despite their arrival. While Transnet has extended free import storage at DCT Pier 2 until October 31st as a temporary lifeline, this relief excludes refrigerated and dangerous goods. Unfortunately, the root causes remain unresolved, and the impact on businesses and consumers continues to mount.

Important Updates You Need to Know:

- MSC has announced a general rate increase (GRI) out of India.

- The USA is facing a potential port strike at the end of September 2024.

- Maersk is experiencing significant delays on its AMEX service due to adverse weather in South Africa and congestion in the US, further exacerbated by the *Jones Act.

- Global port congestion, particularly in Durban, Ningbo-Zhoushan, Vancouver, Los Angeles, and Chittagong, is worsening due to increased container demand. This congestion is leading to a capacity crunch of approximately 1.99 million TEU.

- Far East ocean freight rates have stabilized, with validity extending.

(*The Jones Act, also known as the Merchant Marine Act of 1920, is a federal law that regulates maritime shipping in the United States. It requires that cargo transported by water between U.S. ports must be shipped on vessels that are: U.S.-built, U.S.-citizen owned, Registered in the U.S., Crewed by American,.

Let’s Learn

Forex Tip of the week – SWIFT CODES

SWIFT CODE (BIC)

SWIFT codes (also known as BIC codes) ensure safe and speedy international payments through the SWIFT system. When making an overseas transaction, a SWIFT code is used to verify the identity of the banks or financial institutions. This safety measure helps ensure that funds are sent to the correct account.

Between 8 and 11 characters long, each character of a SWIFT or BIC code provides specific details that can be validated, such as the bank, the country of origin, or the branch location. Once the bank is authenticated, a quick and secure overseas payment can be made.

Why was the SWIFT/BIC code system created?

The Society for Worldwide Interbank Financial Telecommunication (or SWIFT) system was created to provide a standardized and secure way of sending international payments. SWIFT is essentially a messaging network that allows different banks to send and receive information electronically. Thanks to its standardized format, SWIFT helps to avoid confusion between banks in different countries, making payments simpler and faster with less room for error.

On The Ground Report

I think the news shows what is happening on the ground, the people on ground say that the problems at the port (Durban) are getting worse as vessels are moving out hourly and it is something to watch. However, here is a global view, port congestion continues to plague the global shipping industry, causing severe disruptions in supply chains. Key ports, including Durban, are experiencing significant delays, while the ongoing crisis in the Red Sea region has further exacerbated the situation. This congestion has led to a massive capacity crunch, with an estimated 1.99 million TEU (approximately 995,000 40-foot containers) currently unavailable. As a result, shippers are facing increased costs and delivery delays, which could directly impact your operations.

Despite these challenges, global container trade has grown by 7.4% in the first half of 2024, demonstrating resilience in the industry. However, the increased frequency of cancelled sailings, now at 9%, signals ongoing struggles within the sector. The container shipping industry is navigating a complex landscape, where port congestion, geopolitical risks, and supply chain disruptions pose significant challenges. As we continue to monitor these developments, rest assured that we are working closely with our partners to find solutions and minimize the impact on your business.

Disclaimer: Please note: All information presented in this newsletter is based on reputable sources and has been referenced accordingly, this Logistic News is obligation free and if you wish to be removed from the mailing list, please reply to this mail requesting to be removed – all news is adapted or specifically quoted.

NEWS

Transnet truck booking system is a mess – harbour carriers

31 July 2024 – by Eugene Goddard

Source: Nautical Elements

Harbour carriers in Durban are facing significant challenges due to equipment failures, inefficient port management, and alleged corruption within Transnet. The truck-slot booking system at Durban Container Terminal (DCT) Pier 2 is a central issue, with carriers claiming it’s flawed, unfair, and rigged in favour of certain companies.

Harbour carriers, including Ashley Govender and Sue Moodley, have accused Transnet of corruption within the slot booking system, providing evidence but seeing no action. They claim the system is designed to benefit specific companies, leading to congestion and unfair competition. Moodley also criticizes Transnet’s lack of understanding of the ground-level situation.

The carriers have proposed solutions to the congestion, such as utilizing the CX Bay facility for container stacking. However, Transnet requires payment for using this facility and has been unresponsive to suggestions to use other empty spaces within the port. The carriers believe Transnet prioritizes shipping lines over road freighters, resulting in increased costs for carriers.

Transnet CEO Michelle Phillips has denied the allegations of corruption and blamed equipment failures and a recent fibre break for the congestion. She claims to have not received any evidence of corruption from Ashley Govender despite his claims. The carriers maintain that these are excuses, and the core issue lies in the flawed booking system and Transnet’s overall management of the situation. read full story here

Adapted from Source: Freight News

Old problems at Port of Durban infuriate harbour carriers

30 July 2024 – by Eugene Goddard

Source: File photo

Harbour carriers in Durban are increasingly frustrated with the ongoing challenges at the Durban Container Terminal (DCT). They claim that Transnet has been unable to effectively address long-standing issues such as equipment breakdowns and a flawed truck-slot booking system. Despite years of engagement with industry bodies, the situation has only worsened, leading to significant delays and increased costs for transporters.

The truck-slot booking system is a primary point of contention. Carriers argue that the system is fundamentally flawed and has exacerbated congestion at the terminal. The lack of transparency from Transnet regarding the booking process has further eroded trust between the port authority and the industry.

Equipment failures, particularly with straddle carriers, are also contributing to the ongoing problems at DCT. The port’s inability to maintain a sufficient number of operational straddle carriers has resulted in decreased efficiency and increased waiting times for trucks.

The combination of equipment breakdowns, a flawed booking system, and increased container volumes has led to severe congestion at the terminal. This congestion is impacting the entire supply chain, with truck drivers facing long wait times and poor working conditions. Despite claims from Transnet that the situation is improving, industry stakeholders remain sceptical and are calling for urgent and effective solutions..

Adapted from Source: Freight News read full story here

PORTS

South African Port Delays Summary (as of August 5, 2024)

Durban:

- Low wind speeds but experiencing significant delays due to high container volume.

- Pier 1: 11-day delay.

- Pier 2: 15–18-day delay.

- Durban Point: 3-day delay.

Cape Town:

- Windy weather conditions.

- Cape Town Container Terminal (CTCT): 6–7-day delay.

- Multi-Purpose Terminal (MPT): 0–2-day delay.

Port Elizabeth:

- Windy weather conditions.

- Port Elizabeth Container Terminal (PECT): 1–3-day delay.

- Ngqura Container Terminal (NCT): 2–4-day delay.

Overall, all three ports are facing delays, with Durban experiencing the most severe congestion due to high container traffic. Adverse weather conditions have also impacted operations in Cape Town and Port Elizabeth, further complicating logistics and supply chains.

NOTE: We recommend factoring these potential delays into your shipment planning to avoid disruptions.

Port Congestion and Weather Disruptions

- Durban: Severe congestion with average waiting times of 5 days for container vessels.

- Port operations supported by five tugs, a helicopter, two launches, and a pilot boat.

- Floating crane back in service.

- Ngqura: Significant congestion with average waiting times of 2.8 days for container vessels.

- Port Elizabeth: Congestion impacting operations, with average waiting times of 3.7 days for container vessels.

- Severe weather conditions: Strong winds causing widespread disruptions across multiple ports.

- Operational challenges: Reduced efficiency, increased shipping delays, and overall port congestion.

Global Freight Rates

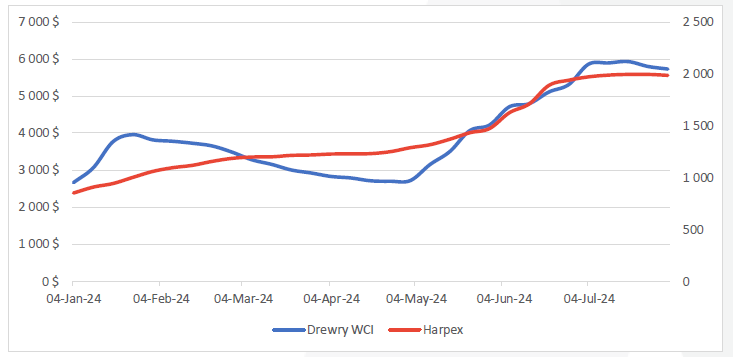

Container freight rates have decreased again this week. Both the Drewry World Container Index and the Harper Petersen Index (Harpex) have fallen. While rates remain higher than the 10-year average due to the pandemic-inflated prices, the overall trend is downward. This suggests a potential cooling off of the historically high shipping costs.

Container Shipping Market Outlook

Shipping Market at a Crossroads

While container freight rates are currently declining, industry experts predict a stabilization at higher levels due to ongoing shipping disruptions. Shipping companies like Ocean Network Express (ONE) are reporting strong financial results driven by increased consumer spending and supply chain tightness. However, the outlook is uncertain due to global geopolitical factors.

The container shipping market is experiencing a shift. Long-term contract rates are rising while short-term rates are softening. This indicates a potential change in market dynamics as industry players prepare for contract negotiations.

Overall, the container shipping market is in a state of flux with both positive and negative indicators present.

BUSA-SAAFF Summary – Summary

Port Operations Deteriorating

- Container handling at South African ports has decreased significantly due to weather disruptions, equipment failures, and congestion.

- Durban, Cape Town, and the Eastern Cape have experienced severe operational challenges.

- Slot booking systems are under strain due to high demand and potential AI-assisted booking.

- Rail and road freight operations are also facing challenges with delays and inefficiencies.

Global Container Industry Mixed

- Global container shipping reliability is declining due to port congestion and weather issues.

- Container trade volumes are increasing but freight rates are decreasing.

- Air cargo volumes are slightly below pre-pandemic levels.

South Africa’s Container Industry Lagging

- South African ports are underperforming compared to targets.

- Trade volumes are declining.

- Addressing equipment shortages, IT systems, security, rail efficiency, and weather resilience is crucial for recovery.

Overall, the South African logistics sector is facing significant challenges that are impacting efficiency and trade. Urgent action is needed to improve port operations, infrastructure, and supply chain resilience.

Key Issues:

- Port congestion and inefficiencies

- Equipment shortages

- Weather disruptions

- Security challenges

- Rail underutilization

- Imbalance in import and export volumes

Potential Solutions:

- Invest in port infrastructure and equipment

- Improve IT systems and security

- Enhance rail efficiency and capacity

- Develop weather contingency plans

- Balance import and export volumes

Source::BUSA

This week’s news was brought to you by:

FNB First Trade 360 – a digital logistics platform and Exporters Western Cape.

“This information contained herein is being made available for indicative purposes only and does not purport to be comprehensive as the information may have been obtained from publicly available sources that have not been verified by FirstRand Bank Limited (“FRB”) or any other person. No representation or warranty, express, implied or by omission, is or will be given by FRB, its affiliates or their respective directors, officers, employees, agents, advisers, representatives or any other person as to the adequacy, reasonableness, accuracy or completeness of this information. No responsibility or liability is accepted for the accuracy or sufficiency thereof, or for any errors, omissions or misstatements, negligent or otherwise, relating thereto. In particular, but without limitation, no representation or warranty, express or implied, is given as to the achievement or reasonableness of, and no reliance should be placed on, any projections, targets, estimates or forecasts and nothing contained herein should be, relied on as a promise or representation as to the past or future. FRB does not undertake any obligation to provide any additional information or to update the information contained herein or to correct any inaccuracies that may become apparent. The receipt of this information by any person is not to be taken as constituting the giving of any advice by FRB to any such person, nor to constitute such person a client of FRB.”