Good morning,

Welcome to another Logistics News Update.

The shipping lines will implement a port congestion surcharge of $210 per TEU, so importers will be paying R7824.60 per 12m/40ft container from December 2023. So if you or anyone else is importing, please remember to put this extra cost into your landed costs.

The first story covers some of the reasons why the port is not operating as it should.

BUSA reported in summary: “The pressure on Transnet to improve performance is coming from all sides – this week from Minister Enoch Godongwana in his MTBPS6. The Minister highlighted that the underperformance of rail in South Africa is estimated to have cost up to 5% of GDP and caused significant losses in the minerals sector alone. The Treasury is working with Transnet to ensure it meets its debt obligations but has stated that Transnet won’t receive bailouts until the government is satisfied that the Freight Logistics Roadmap is being adhered to. Transnet’s financial state has been strained, and the government aims to address these issues to improve logistics efficiency. However, as often mentioned, Transnet – although a critical player – is not solely accountable for the smooth functioning of the extended logistics industry. This responsibility lies on all users, operators, and logistics providers in the country. The ongoing port congestion must be resolved, as the reality of vessel bypasses – and the $200/ TEU congestion charge implemented by Maersk this week, followed shortly after that by MSC – further inhibits the South African economy from growing at desired levels. Consequently, South Africa must get its trade, transport, and logistics network in order, as it is directly involved in 60% of the country’s economy.”

NEWS

Bad weather, breakdowns, and cable theft impact SA’s ports

The Port of Durban, not working like it should. Source: Waldo Swiegers/Bloomberg/Getty

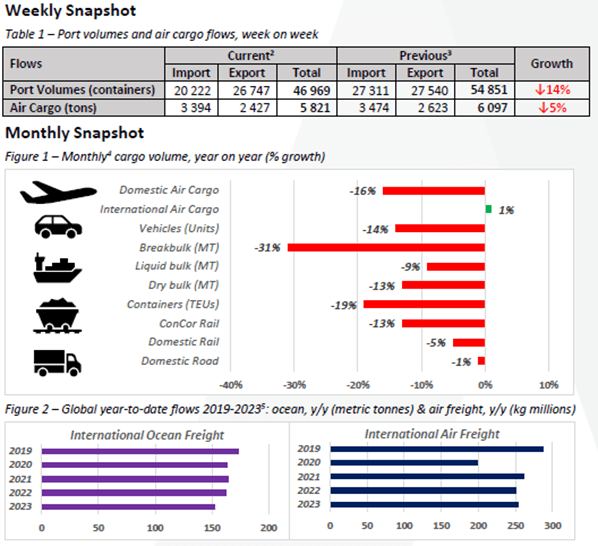

South Africa’s commercial ports handled an average of 6 710 containers per day last week compared to the previous week’s 7 836, representing a significant decrease of 14.36% in the daily average, a Cargo Movement Update has found.

An executive summary of the update compiled by Business Unity SA and the South African Association of Freight Forwarders, said: “Port operations in the last week were characterised primarily by adverse weather conditions, equipment breakdowns and shortages, and internal congestion.” Source: FTW

US Senator Chris Coons proposes immediate review of SA’s Agoa eligibility

US Democratic Party Senator Chris Coons. (Photo: Caroline Brehman-Pool / Getty Images)

His proposed Bill would extend Agoa for 16 years — but possibly eject SA from the preferential trade programme.

Powerful US Democratic Party Senator Chris Coons is circulating a discussion draft of a Bill to renew the African Growth and Opportunity Act (Agoa) for 16 years that would also require an immediate “out-of-cycle” review of South Africa’s eligibility for Agoa.

That could lead to South Africa being removed next year from the programme, which has provided considerable benefits to SA exporters to the US of cars, fruits and wine, in particular. Source: Daily Maverick

US commits to strengthening Africa trade ties

FTW Staff Reporter

Picture Source: FTW

United States Trade Representative, Katherine Tai, reiterated her country’s commitment to strengthening the US-Africa trade and investment relationship to deliver real opportunities across the continent.

Tai was delivering remarks during the closing ceremony of the 20th African Growth and Opportunity Act (Agoa) Forum held in Johannesburg.

Source: FTW

Sars tightens the screws on importers

Nalini Maharaj, a partner in the shipping and logistics division at Shepstone & Wylie. Source: LinkedIn

The growing adoption of digital platforms and the forging of new trade agreements have created a shift in the global economic landscape.

According to Nalini Maharaj, a partner in the shipping and logistics division at Shepstone & Wylie, it is a welcome development which is also evident in South Africa’s readiness to embrace advanced import methods in unison with other countries to enable smoother trade facilitation.

“The industry is undergoing a phase of rapid transformation, and as is the case with all things new, there will be challenges,” said Maharaj, indicating that most of these should be considered opportunities and not setbacks. Source: FTW

Motor vehicle exports rise in October

Motor vehicle exports increased by 39.5% (40 302 units) in October 2023, representing 11 411 more vehicles compared to the 28 891 vehicles exported in October 2022. Vehicle exports for the year to date are now 12.7% ahead of the same period last year.

The National Association of Automobile Manufacturers of South Africa (Naamsa) revealed the performance figures today.

Domestic sales of new light commercial vehicles, bakkies and minibuses amounted to 12 361 units during October 2023. This is a decline of 387 units, or a loss of 3%, from the 12 748 light commercial vehicles sold during October 2022 Source: FTW

02 Nov 2023 – by Staff reporter

Biden ‘wants to make Agoa even better’

Trade ministers up in arms after four African countries were kicked out of programme over human rights

President Joe Biden’s administration wants to work with Congress to improve the US’s flagship trade programme with Africa, not just renew it without changes, US secretary of state Antony Blinken said on Friday. Source: Sunday Time Business

Key Notes

- An average of ~6 710 containers was handled per day, with ~8 408 containers projected for next week.

- Rail cargo handled out of Durban amounted to 2 325 containers for the week, ↓5% (w/w).

- SARS merchandise trade (September): exports ↓3,3% (m/m), imports (↓3,8%); YTD surplus: R43 billion.

- Cross-border queue times were unchanged, with transit times ↑0,3 hours (w/w); SA borders increased by ~3,1 hours, averaging ~13,4 hours (↑30%); Other SADC borders averaged ~8,0 hours (↑18%).

- Global freight rates increased by ↑5% (or $64) to $1 406 per 40-ft container this week. YTD: $1 704.

- Global air cargo is down by ↓1% (w/w), as rates are up by ↑1% and trading at $2,38/kg.

PORTS

Richards Bay

On Tuesday, Richards Bay recorded 17 vessels at anchor: four bulk vessels, ten coal vessels, two breakbulk-, and one liquid bulk vessel. Additionally, ten vessels were recorded on the berth, translating to six at DBT, four at MPT, none at RBCT, and none at the liquid bulk terminal. Two tugs and one helicopter were in operation for marine resources in the 24 hours leading to Wednesday while the pilot boat remained out of commission. During the same period, the coal terminal had two vessels at anchor and one at berth while handling 122 429 kilo-tons on the waterside and 15 trains on the landside.

Eastern Cape ports

NCT on Thursday recorded two vessels on the berth and zero vessels at the outer anchorage, with six drifting. Marine resources of two tugs, a pilot boat, two pilots, and one berthing gang were in operation in the 24 hours leading up to Friday. In the same period, stack occupancy was 56% for GP containers and remained undisclosed for reefers, as a total of 2 117 TEUs were processed. Additionally, 302 trucks were serviced on the landside at a truck turnaround time of ~42 minutes. Towards the end of the week, STS crane 6 was on standby due to high tides. The terminal was heavily impacted by strong winds this week, and these winds were expected to continue over the weekend.

Durban

Pier 1 on Friday recorded two vessels at berth, operated by five gangs, and six vessels at anchor. Stack occupancy is 44% for GP containers and remained undisclosed for reefers as the reefer season is ending. During the same period, 1 288 imports were on hand, with 26 units having road stops and 12 unassigned. The terminal recorded 1 488 gate moves on the landside, with an undisclosed number of cancelled slots and 43 wasted. The truck turnaround time was recorded at ~89 minutes, with an average staging time of ~115 minutes.

Pier 2 had three vessels at berth and 14 at anchorage on Thursday. In the 24 hours leading to Friday, stack occupancy was 44% for GP containers and undisclosed for reefers. The terminal operated with nine gangs while moving 2 493 TEUs across the quay. During the same period, there were 3 041 gate moves on the landside with a truck turnaround time of ~71 minutes and a staging time of ~73 minutes. Of the landside gate moves, 1 034 (34%) were for imports and 2 007 (66%) for exports. Additionally, 1 028 rail import containers were on hand, with 436 moved by rail. The terminal was also quite extensively challenged by inclement weather this week, which directly impacted slot allocation on the landside.

Richards Bay

On Tuesday, Richards Bay recorded 17 vessels at anchor: four bulk vessels, ten coal vessels, two breakbulk-, and one liquid bulk vessel. Additionally, ten vessels were recorded on the berth, translating to six at DBT, four at MPT, none at RBCT, and none at the liquid bulk terminal. Two tugs and one helicopter were in operation for marine resources in the 24 hours leading to Wednesday while the pilot boat remained out of commission. During the same period, the coal terminal had two vessels at anchor and one at berth while handling 122 429 kilo-tons on the waterside and 15 trains on the landside.

Eastern Cape ports

NCT on Thursday recorded two vessels on the berth and zero vessels at the outer anchorage, with six drifting. Marine resources of two tugs, a pilot boat, two pilots, and one berthing gang were in operation in the 24 hours leading up to Friday. In the same period, stack occupancy was 56% for GP containers and remained undisclosed for reefers, as a total of 2 117 TEUs were processed. Additionally, 302 trucks were serviced on the landside at a truck turnaround time of ~42 minutes. Towards the end of the week, STS crane 6 was on standby due to high tides. The terminal was heavily impacted by strong winds this week, and these winds were expected to continue over the weekend.

Container industry summary

The TEU-to-GDP multiplier in the container shipping industry has exhibited a declining trend in the post-pandemic period, representing a sustained weakening compared to previous decades. In the 1990s, this multiplier reached its zenith and remained robustly at 2,6x during the early 2000s. Historically, it served as a dependable metric, signifying that the container trade sector expanded in multiples of GDP growth. However, a fundamental shift has occurred, with the average ratio of container trade growth relative to global economic growth in the past decade decreasing to 0,93x. This decline has only been interrupted by isolated years, such as 2014, 2017, and 2018, which significantly surpassed a multiplier of 1 (1,4x, 1,8x, and 1,4x, respectively).

Summary

Commercial ports handled an average of 6 710 containers per day, significantly down compared to the 7 836 last week. Port operations in the last week were characterised primarily by adverse weather conditions, equipment breakdowns and shortages, and internal congestion. Strong winds in Cape Town ensured that more than 24 operational hours were lost during the week. Durban is currently the only South African Port on the “Port congestion Watch” as more than 60 000 TEUs were stuck at outer anchorage on Tuesday, 31 October. By the end of the week, Crane 3 at GCT was still with the technical team undergoing hoist rope repairs and should return to service sometime over the weekend. Intermittent cable theft took place on the rail network over the previous weekend, causing some delays.

The TEU-to-GDP multiplier in the container shipping industry has declined, reflecting a weakening trend compared to previous decades, as it’s fallen to 0,93x in the past decade. This reality epitomises the current struggles of the industry. In October, new vessel deliveries exceeded 200 000 TEU for the fifth consecutive month, intensifying competition among the top seven container carriers, who are anticipating a record number of new ship deliveries. Charter rates have dropped by ↓25% since June, with Maersk showing a renewed interest in acquiring additional tonnage. Port congestion remains stable but affects around 6% of the industry. Other developments affecting the international market include (1) Suez – and (2) Panama Canal updates.

In the air freight market, international air cargo outbound from South Africa continues to trend upwards and has reached its highest levels since the pandemic. Inbound cargo is slightly down this week but remains relatively close to pre-pandemic levels. Collectively, the market is around ~95% of last year’s levels. Domestic cargo handled at our commercial airports was up ↑2% this week but remains down compared to last year (↓8%) and significantly down compared to the pre-pandemic level (~64%). Internationally, October tonnages track close to last year’s levels (much as in South Africa). The pattern in air cargo tonnages is consistent with the previous year, characterised by a mid-month recovery in tonnages following a sharp drop at the beginning of October.

In regional cross-border road freight trade, average queue times were unchanged, while transit times increased by approximately 20 minuteslast week. The median border crossing times at South African borders increased by more than three hours, averaging ~13,4 hours (↑30%, w/w) for the week. In contrast, the greater SADC region (excluding South African controlled) increased by approximately an hour and a quarter and averaged ~8,0 hours (↑18%, w/w). On average, three SADC border posts took more than a day to cross, notably the usual suspects of Beitbridge, Kasumbalesa (again being the worst affected, with crossing taking nearly three days from the DRC side and two days from the Zambian side), and Martins Drift. Further notable developments included (1) queues affecting cross-border trade at Groblersbrug, Skilpadshek, and Lebombo, (2) Angola, DRC, and Zambia looking to enhance trade corridor by linking Lobito to mining regions, thereby posing a competitive threat to South African ports, and (3) updates on the Trans Kalahari Railway.

In summary, the pressure on Transnet to improve performance is coming from all sides – this week from Minister Enoch Godongwana in his MTBPS6. The Minister highlighted that the underperformance of rail in South Africa is estimated to have cost up to 5% of GDP and caused significant losses in the minerals sector alone. The Treasury is working with Transnet to ensure it meets its debt obligations but has stated that

Transnet won’t receive bailouts until the government is satisfied that the Freight Logistics Roadmap is being adhered to. Transnet’s financial state has been strained, and the government aims to address these issues to improve logistics efficiency. However, as often mentioned, Transnet – although a critical player – is not solely accountable for the smooth functioning of the extended logistics industry. This responsibility lies on all users, operators, and logistics providers in the country. The ongoing port congestion must be resolved, as the reality of vessel bypasses – and the $200/ TEU congestion charge implemented by Maersk this week, followed shortly after that by MSC – further inhibits the South African economy from growing at desired levels. Consequently, South Africa must get its trade, transport, and logistics network in order, as it is directly involved in 60% of the country’s economy. – Source: BUSA

This week’s news was brought to you by:

FNB First Trade 360 – a digital logistics platform & Exporters Western Cape