Welcome to another Logistics News Update.

Brrr! Dress warm!! As icy winds grip South Africa and ports face delays (Durban: Avr. 10 days, Cape Town: up to 6 days), stay warm while we explore the burning issues in logistics:

- Shipping Costs on Fire: This week’s top story – skyrocketing shipping rates from the Far East. Carriers are celebrating record profits, but importers face tough choices.

- Delays Double Down: On top of port delays, origin ports add their own wait times (China: 2-6 days). Remember, our reported delays reflect real port congestion your shipment might face.

- Government Green Light: Great news! Minister Creecy pledges support for the logistics sector, working closely with private entities and the National Logistics Crisis Committee to improve efficiency.

Stay informed, stay warm!

Forex Tip of the week – Non-Deliverable Forwards (NDF)

Ever worry about surprise costs when importing goods? NDFs can help!Imagine you’re an importer, and you need to pay VAT & Duty on your goods. These costs are based on the exchange rate at the time of import, set by SARS (South African Revenue Service). The exchange rate can fluctuate, making it hard to predict your final import cost.Here’s where NDFs come in:An NDF lets you lock in an exchange rate today, even though you won’t be paying those import fees until later.Think of it like a promise for a specific exchange rate down the road.This way, no matter what the exchange rate does in the meantime, you’ll know exactly how much you owe.NDFs help you:Budget better: No more surprises! You’ll know the exact cost of your import VAT & Duty upfront.Manage risk: Protect yourself from sudden currency fluctuations.Think of an NDF as an insurance policy for your import costs. Talk to your Forex Specialist to see if an NDF is right for your next import!**(This is for budgeting purposes and not for speculation)

On The Ground Report

- Delays and Challenges Persist

- Split berthing issues continue to cause disruptions.

- Transporters face difficulties securing bookings, impacting their planning.

- Cold weather may ease congestion in Durban (KZN) due to treacherous road conditions.

- Cape Town harbour on high alert for potential bad weather (level 8 warning).

Disclaimer: Please note: All information presented in this newsletter is based on reputable sources and has been referenced accordingly, this Logistic News is obligation free and if you wish to be removed from the mailing list, please reply to this mail requesting to be removed – all news is adapted or specifically quoted

NEWS

Carriers expect full-year profit as spot market skyrockets

05 July 2024 – by Staff Reporter

Never let the ocean freight container shipping industry lull you into a false sense of security – the next black swan is often only around the corner.

The ocean freight container shipping industry is unpredictable. Even though a report in October 2023 predicted stable rates, the Red Sea crisis caused a surge in demand and spot rates. This is because ships had to take longer routes to avoid the Red Sea, reducing capacity.

Carriers are profiting from the high spot rates, but long-term contracts are not keeping pace and may not be honoured. Shippers should be aware of this and plan accordingly.

The current situation highlights the need for the industry to improve its contracting practices. Contracts should be flexible enough to adapt to changing market conditions.

Overall, the container shipping industry needs to be more proactive in addressing uncertainty. This will help to ensure a more stable and predictable market for all stakeholders.

Adapted from Source: Freight News – here

Growth outpaces infrastructure development

05 July 2024 – by Staff Reporter

Across Africa, the perishable and pharmaceutical industries face challenges due to a lack of investment in cold chain infrastructure. While South Africa boasts well-positioned ports, its infrastructure development is struggling to keep pace with rapid import and export growth.

This situation is even more concerning in many least developed countries, where limited transportation infrastructure hinders the movement of temperature-sensitive goods. Even in countries with pockets of success, a lack of investment and unreliable electricity supplies pose significant challenges. Cold storage facilities often rely on expensive and polluting diesel generators to maintain proper temperatures.

Despite these hurdles, demand for cold chain solutions is rising in Africa, particularly in South Africa, a major exporter of perishable goods. There’s a critical need to improve infrastructure to meet this growing demand.

Adapted from Source: Freight News – read the full here

PORTS

Summary of Port Operations

Logistics Update: Weather Impact and Port Delays

Carrier scheduling remains unpredictable, with blank sailings, port omissions, rollovers, and sudden voyage changes. Additionally, extreme weather conditions—strong winds, high waves, and heavy rain—are forecasted along the South African coastline. Specifically, between Cape Town and Port Elizabeth, vessel movement and operations will be affected.

- Shipping Delays Expected Due to Weather and Scheduling Issues

- Unreliable Schedules: Carriers continue to experience disruptions, including cancelled sailings, port skips, and last-minute changes.

- Weather Warnings: Be aware of severe weather expected along the South African coast, particularly between Cape Town and Port Elizabeth. This will cause delays for vessels.

Port Delays:

- Durban: Piers 1 (11-13 days), Pier 2 (12-15 days), and Point (3 days)

- Cape Town: CTCT (1-3 days) and MPT (0-2 days)

- Port Elizabeth: Container Terminal (1-2 days)

Container Freight Rates on the Rise

- Global Container Shipping Rates Rise Again

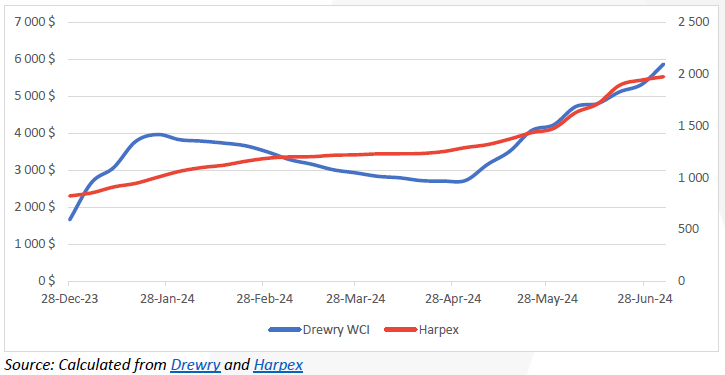

- Container freight rates jumped by 10.3% this week.

- Drewry’s World Container Index reached $5,868 per 40-foot container, driven by increases on major routes from China.

- Shanghai to key destinations like Rotterdam, Genoa, Los Angeles, and New York all saw rate hikes.

- Charter rates, as measured by the Harper Petersen Index (Harpex), also climbed by 1.7% this week.

Global Container Ship Boom Slowing Down

The rapid growth of the global container ship fleet is starting to ease. Here are the key points:

- Peak deliveries reached: The first half of 2024 saw a surge in new container ships, adding 1.68 million TEU (Twenty-Foot Equivalent Unit) of capacity.

- Red Sea rerouting impact: Diverting ships around the Red Sea crisis took out roughly the same amount of capacity (1.6 million TEU) that was added.

- Deliveries continue but slow down: An additional 1.49 million TEU of capacity is expected in the second half of 2024, with a decrease in the monthly delivery rate.

- Shifting deployments: More container ships are being used on routes between Asia and Europe, while capacity on other routes (except Latin America) grew slower than the global average.

- Latin America on the rise: Deep sea and regional liner services to and from Latin America saw a significant capacity increase (17.4%).

BUSA-SAAFF Summary

Government Reshuffle Shakes Up Trade and Transport Sectors in South Africa

South Africa’s recent cabinet reshuffle brings new leadership to the Departments of Transport and Trade, Industry, and Competition. These changes are seen as positive for the trade, transport, and logistics industry, with a focus on economic growth and a business-friendly environment.

- Transport: Barbara Creecy’s appointment as Minister and Mkhuleko Hlengwa as Deputy emphasizes the government’s commitment to improving state-owned entities like Transnet, crucial for the nation’s ports, rail, and pipelines.

- Trade & Industry: Parks Tau takes the helm with deputies Zuko Godlimpi and Andrew Whitfield. This signals a focus on driving economic growth.

Challenges and Opportunities:

- The disbanding of the Department of Public Enterprises could lead to short-term hurdles as a new oversight model is implemented.

- The new Government of National Unity will need to carefully manage potential risks associated with these structural changes, especially for the critical national logistics network.

Overall, the reshuffle presents both challenges and opportunities for the trade, transport, and logistics industry in South Africa.

Adapted from :BUSA

This week’s news was brought to you by:

FNB First Trade 360 – a digital logistics platform and Exporters Western Cape

“This information contained herein is being made available for indicative purposes only and does not purport to be comprehensive as the information may have been obtained from publicly available sources that have not been verified by FirstRand Bank Limited (“FRB”) or any other person. No representation or warranty, express, implied or by omission, is or will be given by FRB, its affiliates or their respective directors, officers, employees, agents, advisers, representatives or any other person as to the adequacy, reasonableness, accuracy or completeness of this information. No responsibility or liability is accepted for the accuracy or sufficiency thereof, or for any errors, omissions or misstatements, negligent or otherwise, relating thereto. In particular, but without limitation, no representation or warranty, express or implied, is given as to the achievement or reasonableness of, and no reliance should be placed on, any projections, targets, estimates or forecasts and nothing contained herein should be, relied on as a promise or representation as to the past or future. FRB does not undertake any obligation to provide any additional information or to update the information contained herein or to correct any inaccuracies that may become apparent. The receipt of this information by any person is not to be taken as constituting the giving of any advice by FRB to any such person, nor to constitute such person a client of FRB.”