Welcome to another Logistics News Update.

It certainly feels like judgement day — a sweeping 30% tariff has now been imposed on all goods originating from South Africa, unless specifically excluded.

CLICK HERE attached the list of exempted items; if your product isn’t listed, the 30% tariff applies.

What does this mean for us? We’re already seeing global markets under pressure. The strange thing is that South Africa does not charge 60% as stated by the US President, we on an average of 7½%, let’s hope that our discussions with the USA are fruitful and we are able to navigate the problem presented. It is also a time where we must start looking at other markets and the Africa Free Trade Agreement is a place to start.

We also think, this is the start and not the end. As we know, President Trump is a negotiator and this will allow countries like Vietnam to negotiate. They have said zero tariffs for any USA products, the USA will reciprocate, and this make them the first to market.

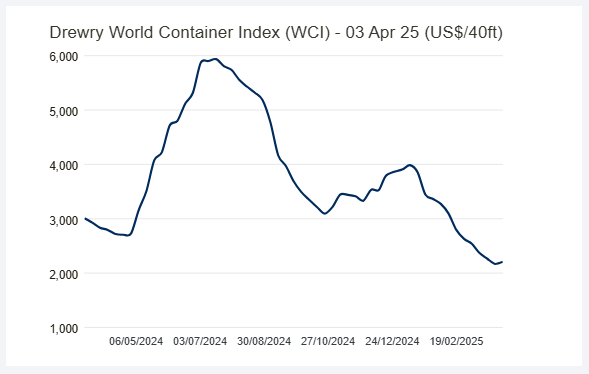

The rand is trading above R19.50 to the dollar, which is far from ideal for an import-driven economy. Container rates out of China have dropped — some sources report a 28% decline based on 2019 figures, but the actual drop since December 2024 is closer to 43%. However, don’t get too comfortable. Rate increases are likely to follow, as we’ve seen time and again: shipping lines manage capacity through blank sailings, driving up demand and, ultimately, prices.

We truly are navigating uncertain times. Please ensure that all accounting systems are updated — an additional 0.5% will be levied on all Value Added Tax from 1 May 2025.

On The Ground

SARS VAT Number Validation Update

SARS has reinforced the requirement for VAT-registered traders to correctly reflect their VAT numbers on all customs declarations. From 1 April 2025, any declaration with a VAT number that is valid but not correctly linked to the trader will be rejected. Currently, invalid, or inactive VAT numbers already result in rejected declarations, and warning messages are sent for incorrect linkages. Traders with multiple VAT and Customs codes must ensure accurate linkage to avoid disruptions. For assistance, traders are encouraged to use the SARS Registration, Licensing, and Accreditation process or visit a SARS office. Please CLICK HERE FOR attachment.

Let’s Learn: What is a Tariff?

We have covered this, but a refresher is good considering what we are going through. With the trade war ongoing, let’s understand the real reason we have tariffs. A tariff is a tax imposed by a country on goods imported from abroad. In South Africa, SARS uses tariff codes (also called HS codes) to classify goods and determine the correct amount of duty and VAT payable on each item.

Why are tariffs important?

- They protect local industries by making imported goods more expensive

- They generate revenue for the government

- They ensure accurate classification of goods for customs clearance

What importers need to know:

- Each product has a unique tariff code — it’s essential to get this right

- Incorrect tariff codes can lead to penalties, clearance delays, or overpaying duties

- Some tariff codes come with rebates, exemptions, or special conditions

💡 Tip: Always check with your clearing agent or logistics partner (like us!) to ensure your goods are classified correctly — it could save you thousands.

Remember, it’s the country that you are sending your goods to that have to deal with the tariff, it does put you at a price disadvantage if you are competing with a country that has a smaller tariff imposed on it.

NEWS

Tariff turbulence: charting the future of global container shipping

7th April 2025 – Staff Reporter

The recent tariffs introduced by President Donald Trump have significantly altered global trade dynamics, necessitating strategic adaptations within the container shipping industry. Peter Sand, chief shipping analyst at Xeneta, emphasises the importance for companies to understand current market trends and maintain flexibility in their operations. Since early 2025, average spot rates for shipments from the Far East have declined by 43% and 50% to the U.S. East and West Coasts, respectively, reflecting the waning of the forward-loading surge observed in 2024.

Sand advises shippers to base their decisions on solid data, avoiding reactions to short-term market fluctuations. He recommends negotiating contracts that include provisions for renegotiation in response to significant market shifts, ensuring that long-term agreements offer both competitive rates and strategic adaptability. This approach is vital as companies reassess trade routes, shift production hubs, or change service providers to navigate the evolving trade environment.

Furthermore, Sand highlights the necessity for innovative supply chain strategies in light of the new tariffs. For instance, since Brazil is exempt from the heavy U.S. tariffs affecting other countries, shippers might consider routing goods from China through Brazil before transporting them to the U.S. East Coast. This strategy would require establishing Brazil as the origin of goods, potentially involving repackaging or repurposing. Such inventive workarounds are becoming essential for building versatile and responsive supply chains in the current global trade landscape…..

– Source: FreightNews & Stat Media Group

WEEKLY NEWS SNAPSHOT

Trade and Tariffs

- US Tariffs Impact South Africa: The recent tariffs imposed by President Donald Trump have led to significant market turmoil, with the S&P 500 experiencing a 14% decline over three trading days, erasing over $6 trillion in value.

Shipping and Freight Rates

- Decline in Chinese Export Freight Rates: The first quarter of 2025 saw a 28% drop-in average freight rates for Chinese exports, marking the steepest decline in two decades. This is attributed to factors like overcapacity and geopolitical tensions.

Logistics and Infrastructure

- Transnet’s Strategic Initiatives: Transnet has issued a call for proposals to develop a terminal at the Port of Cape Town, aiming to enhance the port’s capacity to handle high-flash products such as molasses and vegetable oils.

- Innovations in Maritime Operations: CMA CGM has partnered with a startup to implement AI-optimized trade route reconfiguration, potentially saving carriers up to $100,000 per vessel annually

Border and Customs

- Border Operations Streamlining: Emphasis has been placed on the importance of accurate paperwork to ensure smooth border operations, highlighting challenges that arise when regulations change without adequate notification.

- Rise in Smuggling Activities: The United States has reported an increase in egg smuggling, driven by price disparities between the U.S. and Mexico

Port Operations Summary: – Port Update:

SOUTH AFRICAN PORTS

Durban

The port experienced low wind speeds this week.

- Pier 1: 0–2 days delay

- Pier 2: No delay

- Durban Point: 3 days delay

Cape Town

The port was impacted by strong winds throughout the week.

- CTCT: 7–10 days delay

- MPT: No delay

Port Elizabeth

The port experienced windy conditions during the week.

- PECT: 0–1 day delay

- NCT: No delay

Source: SACO

Global Freight Rates

World Container Index – 3 April 2025

Drewry’s World Container Index (WCI) experienced a slight uptick, rising by 2% to reach $2,208 per 40-foot container. This marks the first increase after 12 consecutive weeks of decline. Despite this rise, the index remains 79% below its peak of $10,377 in September 2021 but is still 55% higher than the pre-pandemic average of $1,420 in 2019. The year-to-date average for 2025 stands at $2,993 per 40-foot container, which is $105 above the 10-year average of $2,887.

Rate Fluctuations on Major Routes:

- Shanghai to Los Angeles: Rates increased by 10% ($239) to $2,726 per 40-foot container.

- Shanghai to New York: Rates rose by 8% ($272) to $3,894 per 40-foot container.

- Rotterdam to Shanghai: Rates decreased by 7% ($34) to $466 per 40-foot container.

- Shanghai to Genoa: Rates fell by 4% ($140) to $3,031 per 40-foot container.

Market Insights:

The recent uptick in transpacific rates is attributed to a series of sailing cancellations, which have tightened capacity on these routes. Additionally, the announcement of new tariffs by President Trump on 2 April 2025 is expected to introduce further volatility into the spot freight rate market. Drewry advises shippers and cargo owners to remain flexible and responsive to these evolving trade conditions, as the market continues to adjust to these developments.

South African Trade Routes:

- Far East to South Africa (Durban): The Shanghai Containerized Freight Index (SCFI) indicates rates to Durban have decreased by 2.5%.

- South Africa to Europe: Recent reports suggest that carriers are implementing rate increases on this route. For instance, MSC announced new freight rates from South Africa to Europe.

💡 Insight: The rerouting of vessels around the Cape of Good Hope, due to security concerns in the Red Sea, has extended journey times by up to two weeks, contributing to increased freight costs on certain routes.

– Source: Drewrey

Disclaimer: The information provided in this newsletter is based on reliable sources and has been carefully verified. This Logistics News is distributed free of charge. If you wish to unsubscribe from our mailing list, please reply to this email with “unsubscribe” in the subject line. Please note that all content is adapted or directly quoted from its original sources. We take no responsibility for any inaccurate reporting; we are only adapting the news for you.

This week’s news was brought to you by:

FNB First Trade 360 – a digital logistics platform and Exporters Western Cape

“This information contained herein is being made available for indicative purposes only and does not purport to be comprehensive as the information may have been obtained from publicly available sources that have not been verified by FirstRand Bank Limited (“FRB”) or any other person. No representation or warranty, express, implied or by omission, is or will be given by FRB, its affiliates or their respective directors, officers, employees, agents, advisers, representatives or any other person as to the adequacy, reasonableness, accuracy or completeness of this information. No responsibility or liability is accepted for the accuracy or sufficiency thereof, or for any errors, omissions or misstatements, negligent or otherwise, relating thereto. In particular, but without limitation, no representation or warranty, express or implied, is given as to the achievement or reasonableness of, and no reliance should be placed on, any projections, targets, estimates or forecasts and nothing contained herein should be, relied on as a promise or representation as to the past or future. FRB does not undertake any obligation to provide any additional information or to update the information contained herein or to correct any inaccuracies that may become apparent. The receipt of this information by any person is not to be taken as constituting the giving of any advice by FRB to any such person, nor to constitute such person a client of FRB.”